Regime Check: Cooling After the Surge

Last week felt different.

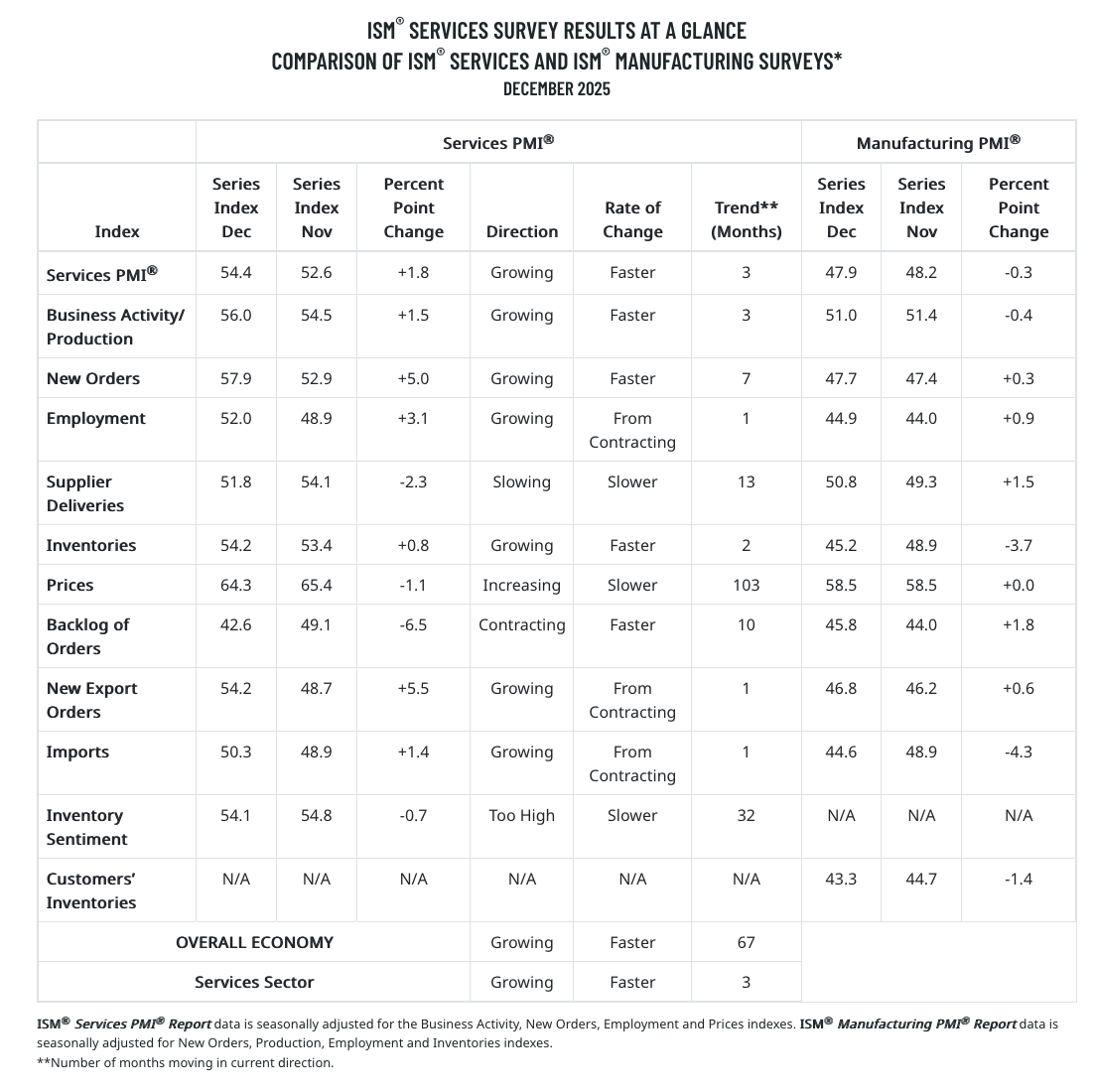

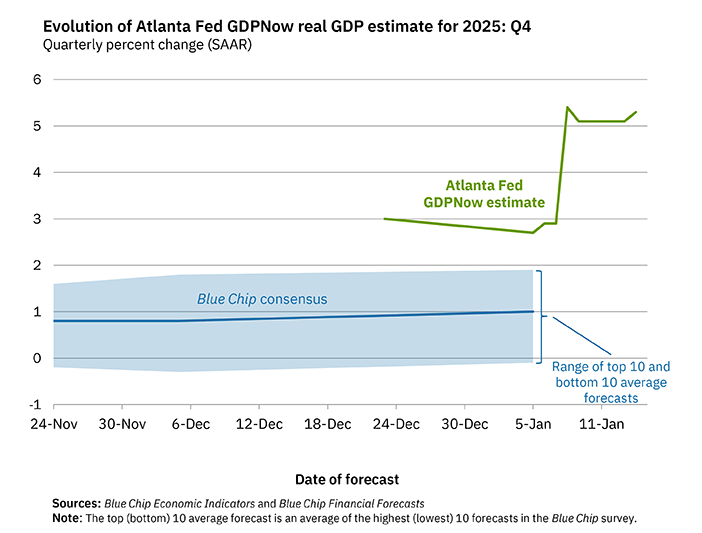

ISM Services surging to 54.4. GDPNow tracking north of 5%. The divergence check flashing "Boom / Reflation" for the first time in weeks. There was heat building real momentum in the system. I wrote about services accelerating while labor cracked, trying to make sense of data that refused to reconcile.

This week? Different story entirely. The heat's coming off.

Policy decelerated. Risk Appetite decelerated. The aggregate score dropped from +1 to 0; sounds modest, but it shifts the entire complexion of the read. More importantly, that divergence implication reversed. Back to "Soft Landing" from "Boom / Reflation." And Reflation probability? Cut nearly in half. From 15% down to 8%.

Same regime classification on paper. Completely different mood underneath.

Now, to be clear: nothing has collapsed. ISM Services still printing 54.4. New orders positive. Financial conditions loose. The underlying foundation hasn't crumbled. What's changed is the momentum, the system that was accelerating is now coasting. Maybe consolidating. Maybe rolling over. Too early to know which.

I've learned to pay attention when the framework cools after a hot reading. Usually means the signal overshot, not that conditions fundamentally changed. The question, and it's an honest one, is whether this pause is consolidation before another leg higher, or the early stages of something less pleasant.

Three signposts still triggered. USD/JPY above 152. DXY below 100. Gold above $300. That currency cluster hasn't budged. If anything, with USD/JPY pushing even higher 158, we are deeper into intervention territory.

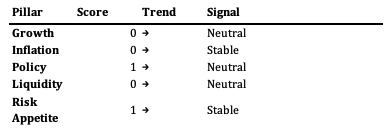

MacroAnalytix Dashboard Scoring

Current Regime: Neutral/Chop | Aggregate Score: 2 | Conviction: Minimal

What's the story here? Normalization. Last week's reflationary signals probably overshot. The framework is finding a more sustainable equilibrium which isn't necessarily bad news. But it does mean the easy directional call many were hoping for hasn't materialized.

Growth: Stable Foundation, Divergence Resolved

Growth holds at 0. Neutral. Trend stable.

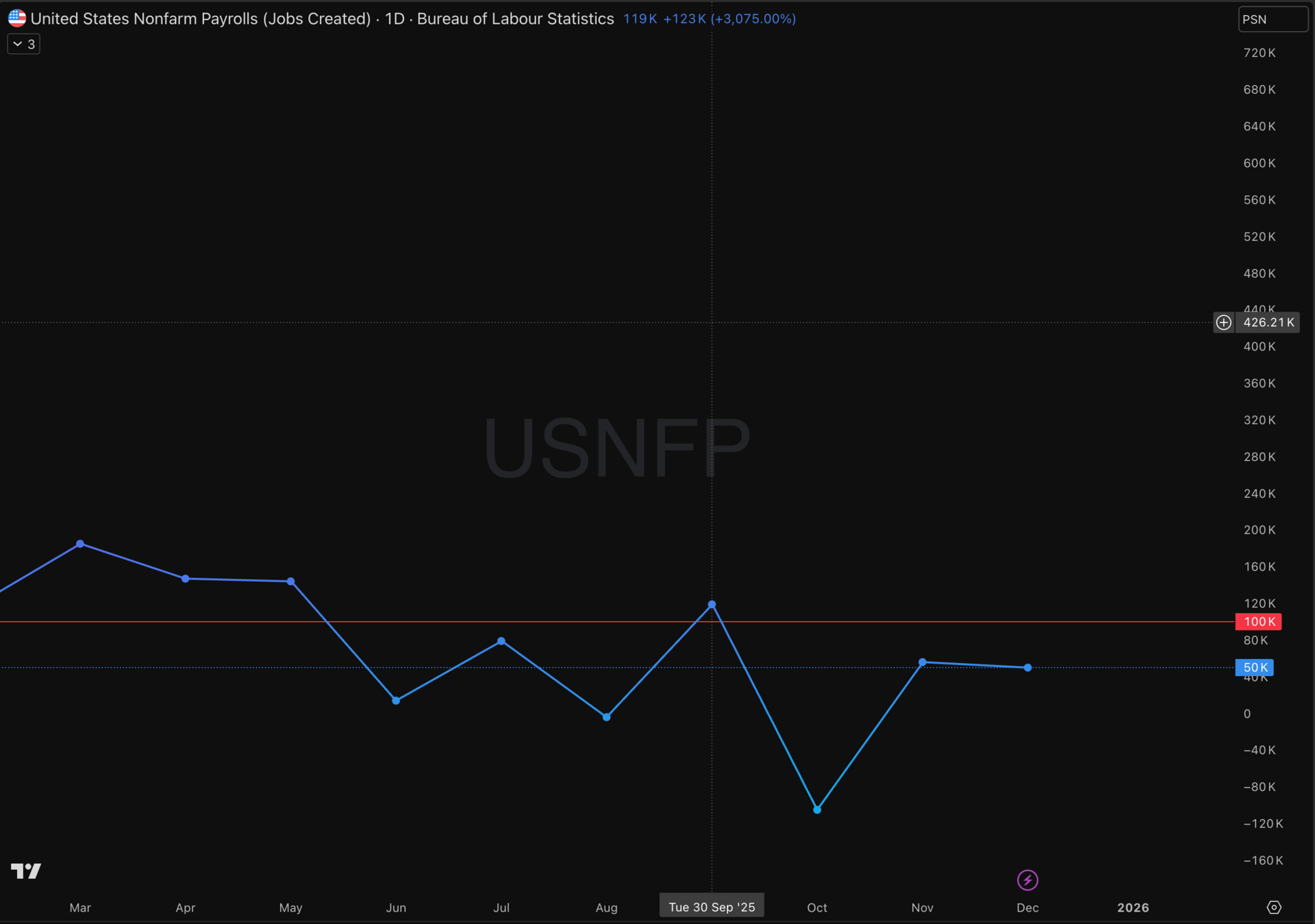

Remember last week's puzzle? ISM Services surging while NFP cracked? That divergence dominated the narrative. Well, it hasn't resolved through new data, the numbers are basically unchanged. What shifted is how the framework interprets them.

The divergence check now reads "Aligned" with a "Soft Landing" implication. Last week: "Boom / Reflation." That's a meaningful reframe of the same underlying signals.

Let me walk through what actually moved:

ISM Services: 54.4. Unchanged. Still solidly in expansion.

NFP 3-month average: 52k. Unchanged. Still concerning.

ISM New Orders minus Inventories: +2.5. Sustained positive and this one matters more than people realize.

GDPNow: 5.3%, up from 5.1%. Still tracking hot (Q4 2025).

Leading indicators score 0.3. Coincident indicators score 0. Both stable, both aligned. The "Soft Landing" implication suggests the framework now sees controlled deceleration rather than an accelerating boom. Subtle shift, but it changes the positioning calculus.

GDPNow at 5.3% seems inconsistent with "soft landing," I know. Here's the thing though, GDPNow tracks current quarter GDP from high-frequency data. Tells you where we are. The regime framework tries to identify where we're headed. Those are different questions. The leading indicators feeding the divergence check are softer than that headline growth number suggests.

When current data and leading data disagree? I lean toward the leading side. Not always right, but that's the bet.

For the deeper analysis on services-labor tension, see Issue #006. That framework still holds.

Growth Score: 0 (Neutral) | Trend: ↑ | Divergence Implication: Soft Landing

Inflation: Pipeline Clearing Returns

Genuinely good news here.

Last week, all the regime flags read "No." No stagflation risk. No reflation signal. No disinflation signal. Momentum mixed. Felt like inflation progress had stalled entirely.

This week: "YES - Pipeline Clearing."

What changed? The pipeline analysis shows clearer progression through the three stages. Worth walking through:

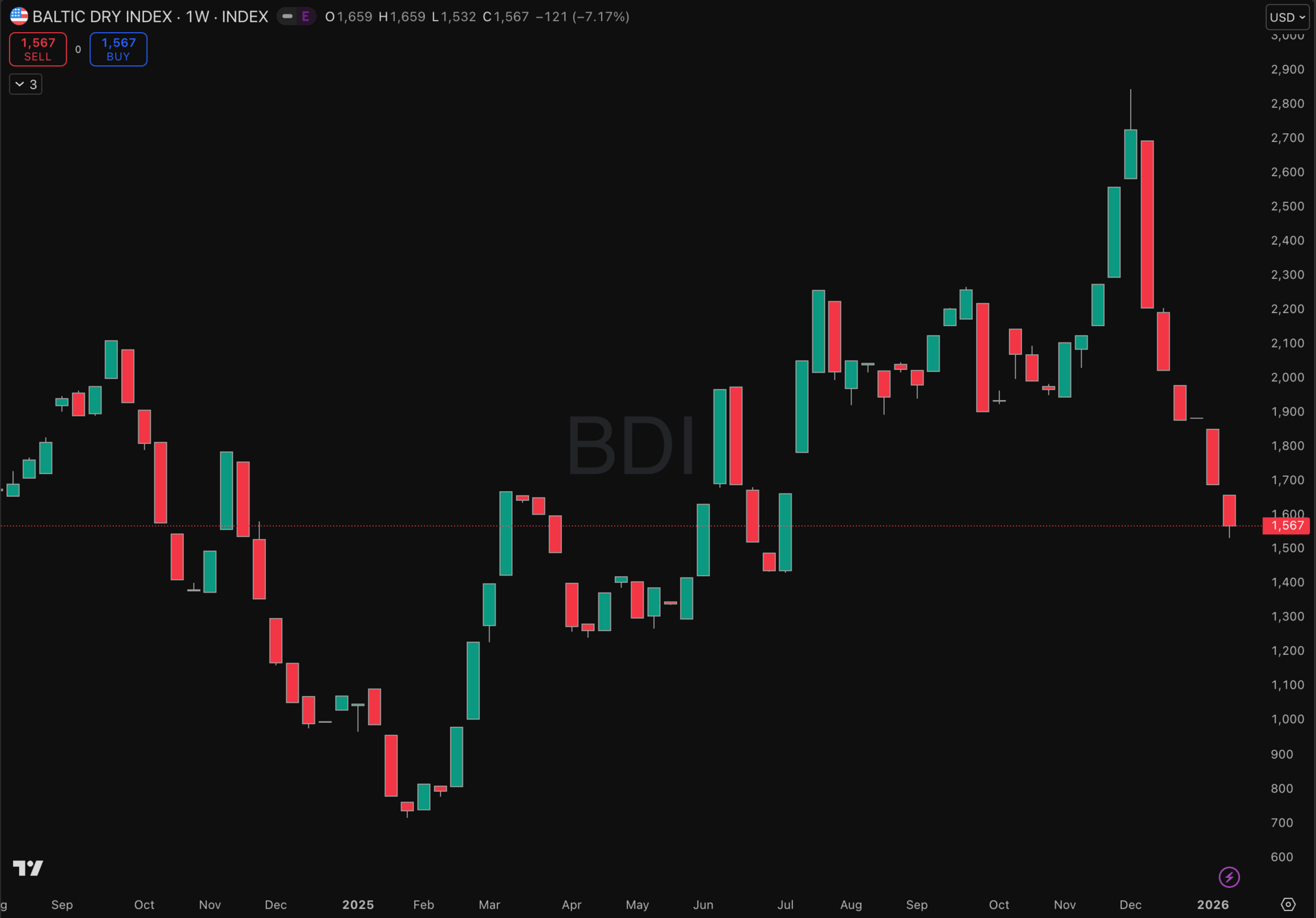

Upstream (20% weight): CRB commodities at 379.22, accelerating modestly. But Baltic Dry collapsed further—1,567 from 1,688. Shipping costs still falling hard. Global trade pricing pressure remains muted. Score: 0.

Source: TradingView - BDI

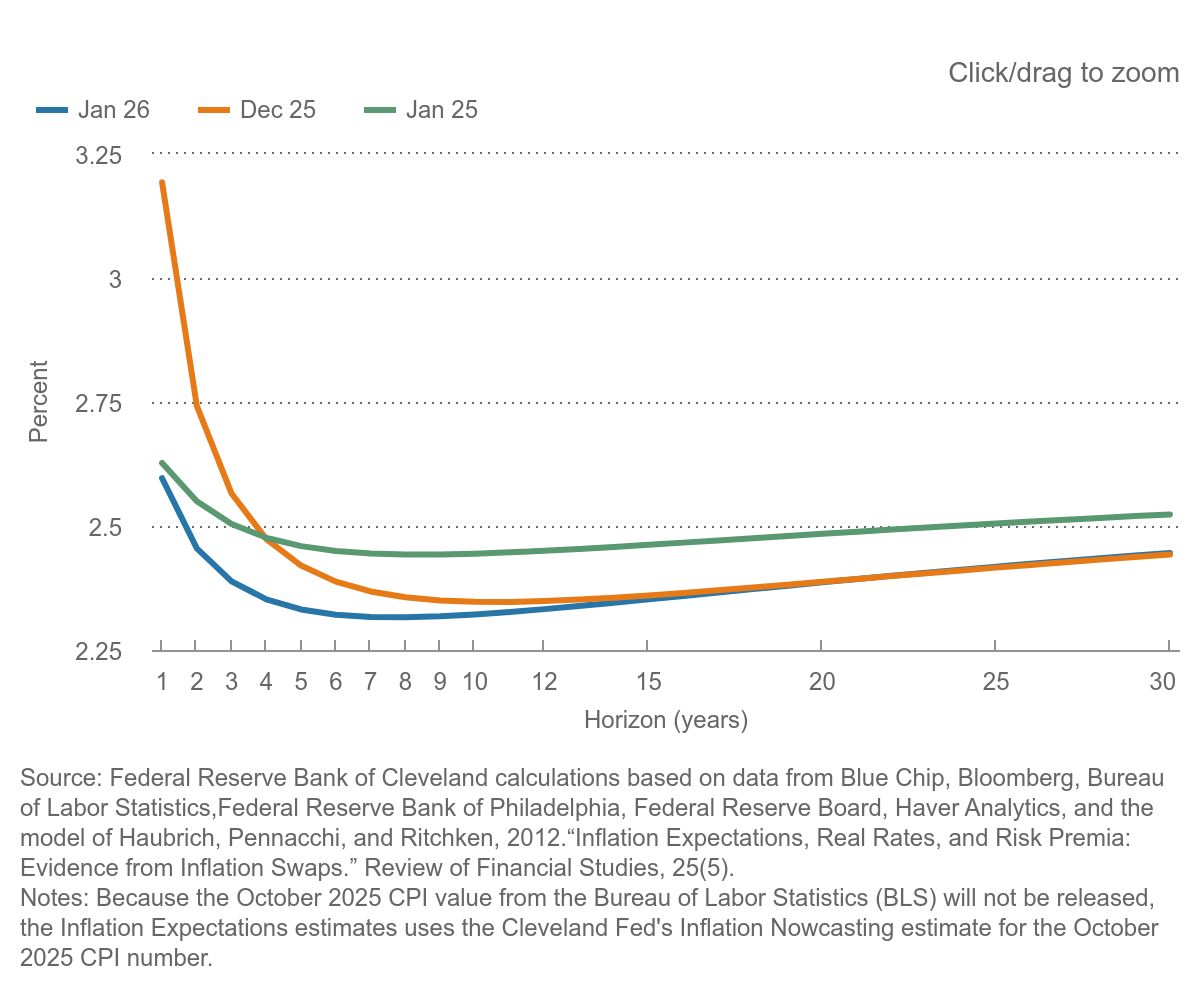

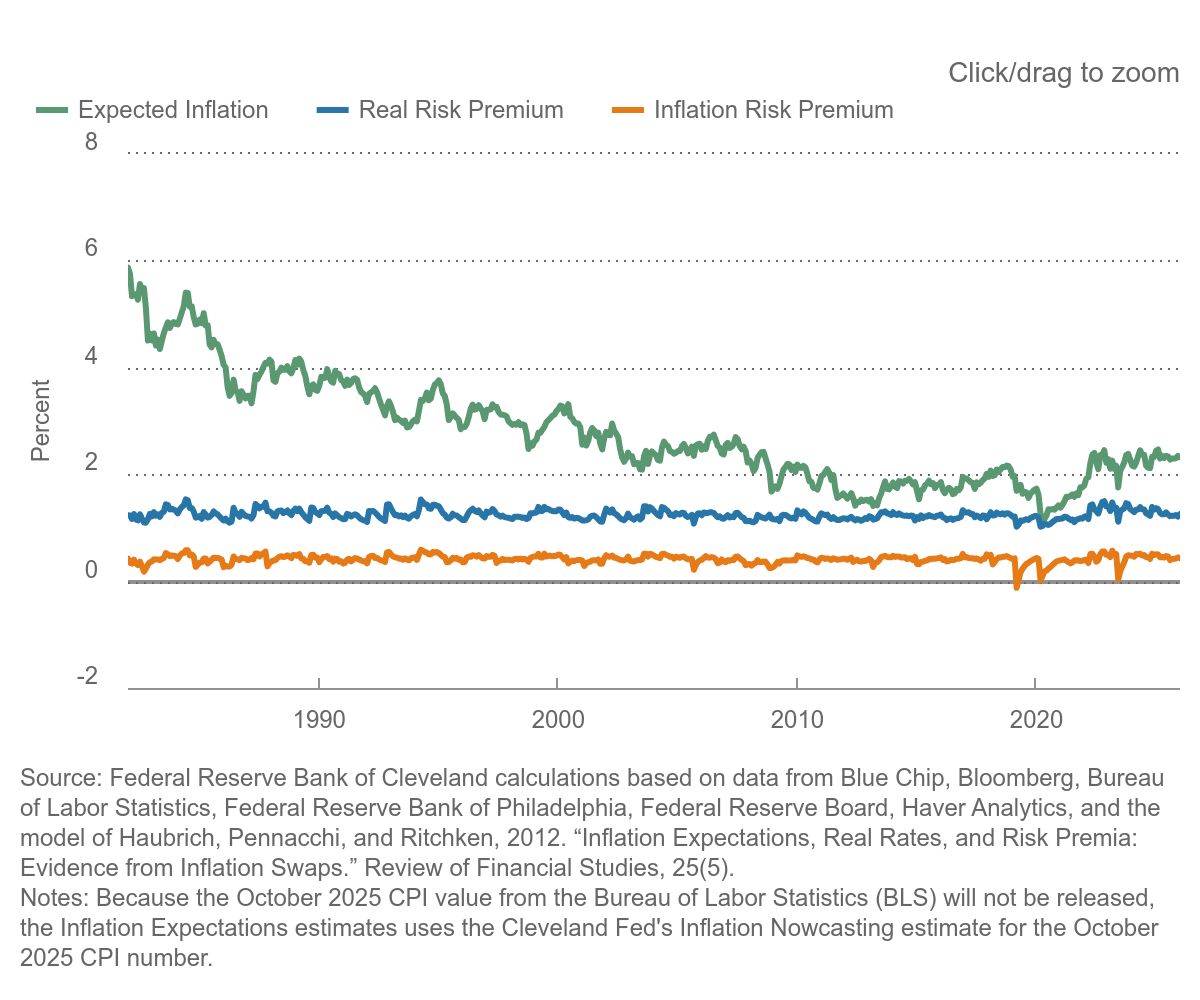

Midstream (25% weight): Expectations anchored. 5Y5Y forward at 2.27%. 10Y breakevens at 2.25%. Both stable. Both inside the Fed's comfort zone. Bond traders aren't worried about inflation—and bond traders are rarely wrong for long. Score: 0.

Source: https://www.clevelandfed.org/indicators-and-data/inflation-expectations - Inflation Expectation Term Structure.

Source: https://www.clevelandfed.org/indicators-and-data/inflation-expectations - 10Y Inflation Expectation

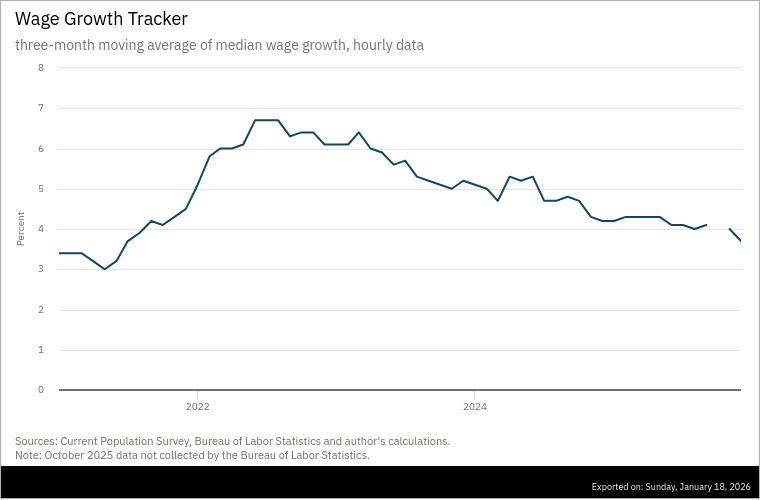

Downstream (55% weight): This is where it matters most. Supercore PCE, services ex-housing, the stickiest component, the metric Powell watches closest at 3.8% and decelerating. Atlanta Fed Wage Tracker at 4.2%, falling. Core PCE at 2.83% with the 3-month annualized running 3.2%, still hot near-term, but trend pointing right. Score: 0.

The "Pipeline Clearing" flag triggers when upstream and midstream aren't building pressure while downstream decelerates. That's exactly what we're seeing. No stagflation risk. No reflation signal. Just gradual normalization toward target.

Boring is good here.

One caveat on tariffs: pass-through remains contained for now. Upstream commodities up 2.66% YoY. Midstream PPI up 3.3%. Downstream Core CPI barely positive at 0.03% YoY change. Pipeline isn't transmitting cost pressures to consumers yet. I remain skeptical this holds through Q2 if tariff rhetoric becomes tariff action but that's a future problem.

Inflation Score: 0 (Stable) | Trend: ↓ | Pipeline Status: Clearing

Policy: Accommodative but Decelerating

Policy score is stable.

The raw composite is still positive, sitting at 1 but momentum has stalled. That's the story this week. Not the level. The deceleration. Fed on hold. Markets have digested the "one cut for 2026" guidance. Now everyone's waiting.

Waiting for what, exactly? Good question.

Fed Funds effective at 3.72%. Real Fed Funds at 0.89%, still positive, technically restrictive relative to neutral, but less so than last year's peaks. The easing that's already happened is in the rear-view. Question now is whether more is coming.

Financial conditions? Still loose. Very loose, actually:

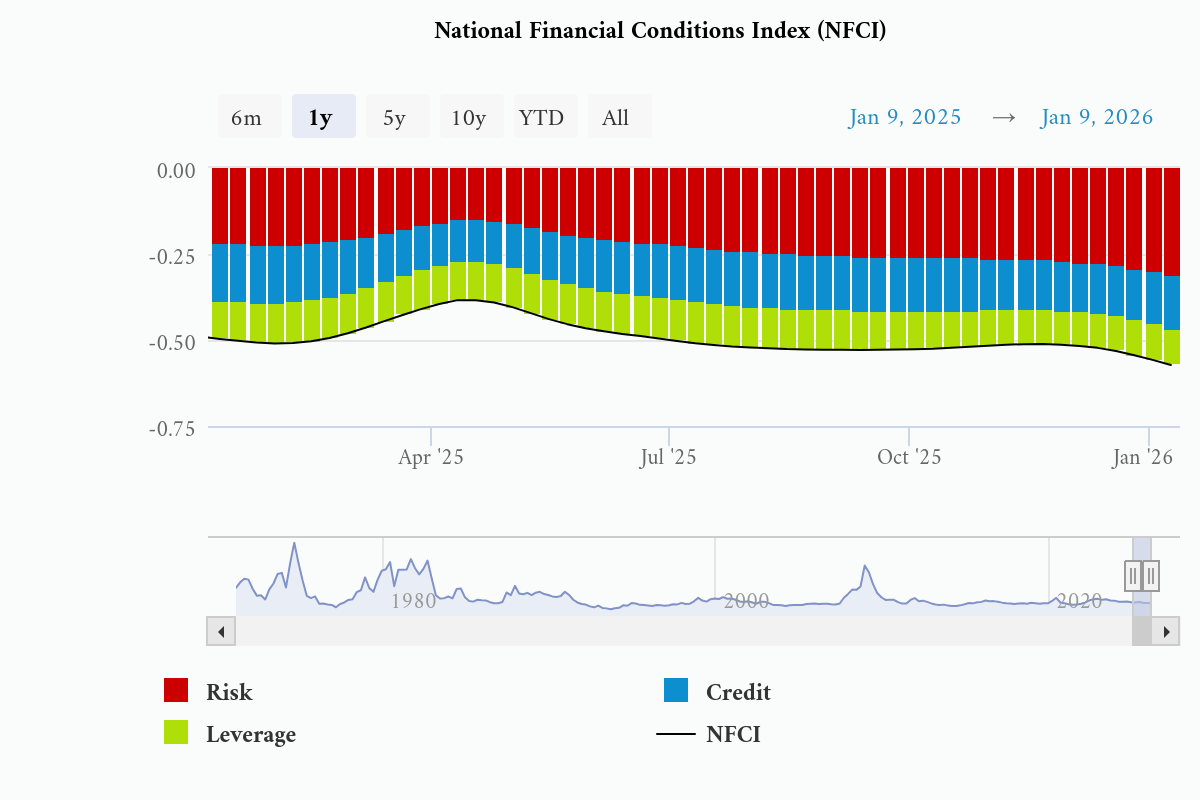

Chicago Fed NFCI at -0.57. Even easier than last week's -0.55.

GS FCI shows loosening conditions.

10Y-3M spread at 57 bps. No recession signal there.

Here's something worth flagging: fiscal is stimulative. Impulse running at +2.3% YoY. Government adding demand quietly, while everyone focuses on the Fed.

So now we have monetary policy already accommodative. Fiscal running hot. Both levers pulling the same direction. Policy Mix Matrix flags this as "Both Loose = Bubble Risk." That's not a warning to ignore. When both policy channels run accommodative simultaneously, asset prices can decouple from fundamentals. S&P at 22x forward earnings with a 6% deficit and 3.7% Fed Funds? The conditions for multiple expansion on liquidity rather than earnings are present.

Not there yet. But the setup exists. Worth watching.

The deceleration itself comes from the monetary score cooling as markets fully digest the hawkish hold message. One cut for 2026. That's priced. The question mark: will they need to do more if growth softens? Or hold firm if inflation proves stickier than the pipeline suggests?

Policy Score: 1 (Neutral) | Trend: ↑ | Policy Mix: Both Loose

Liquidity: Buffer Gone but Net Rising

I've been banging on about this for weeks.

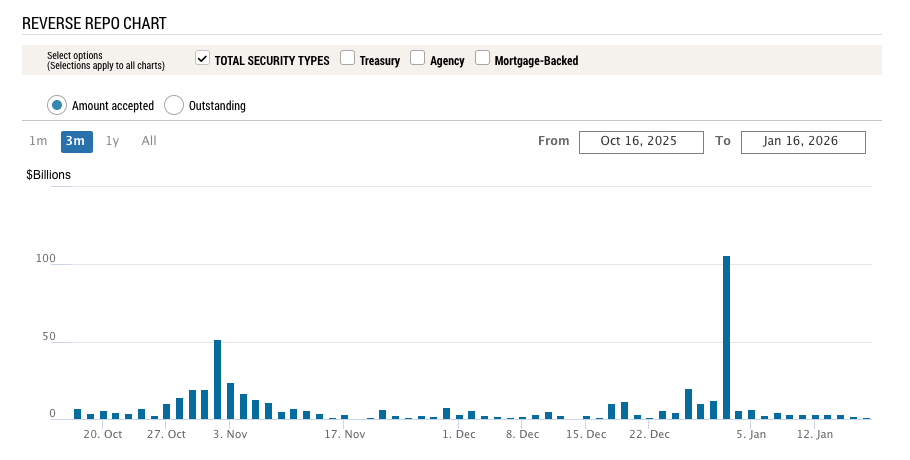

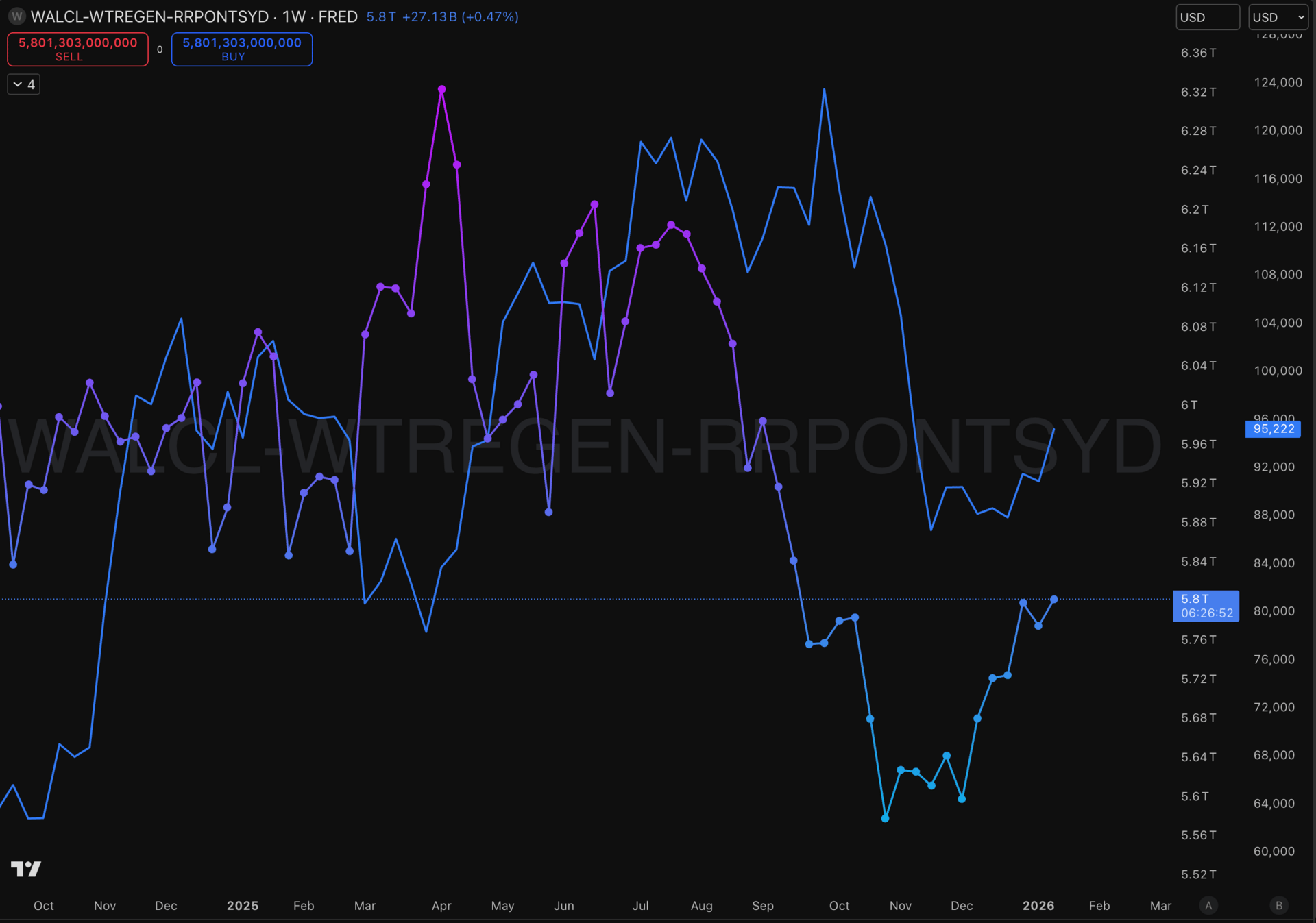

I tracked this drain since December. From $106 billion. To $3 billion. To now $1.2 billion. That buffer absorbed funding stress in 2022-2023. Prevented repo spikes from cascading. Gave the Fed time to react to plumbing problems.

Gone.

Any future funding squeeze hits bank reserves directly. No cushion. No margin for error.

But net liquidity actually rose. Current reading: $5,801.78 billion, up $27 billion from last week. Fed balance sheet ticked to $6,582 billion. TGA fell to $779 billion, releasing reserves into the system.

Simple math: Fed BS ($6,582B) minus TGA ($779B) minus RRP ($1.2B) = Net Liquidity ($5,801.78B)

BTC at $95,290, up from $90,667, tracking net liquidity as usual. Say what you will about crypto but it's a useful real-time liquidity barometer. When BTC diverges from net liquidity, something's usually brewing.

Source: TradingView - Net Liquidity vs. Bitcoin

Plumbing stress? Normal for now:

SOFR-Repo at 10 bps. Up from 8. Nowhere near December's 35 bps stress.

MOVE index at 66.9. Rates vol subdued.

The concern isn't today but watch the plumbing checks. They'll show trouble before headlines do.

Liquidity Score: 0 (Neutral) | Trend: ↑ | RRP Buffer: Exhausted

Risk Appetite: Quality Holds, Greed Fades

Another stable pillar.

Like Policy, this is deceleration more than deterioration. Market isn't panicking. Just less enthusiastic than seven days ago.

Validation system still passes all four checks:

Credit Check: PASS. HY spreads at 271.

Internals Check: PASS.

Global Check: PASS. AUD/CHF at 0.537, neutral.

Vol Check: PASS. VIX at 15.86, term structure in contango.

Rally Verdict: HIGH QUALITY - Size Up

Four passes means the framework considers this rally real. Not a bear market bounce. Not low-quality speculation. That hasn't changed.

What has changed? The mood.

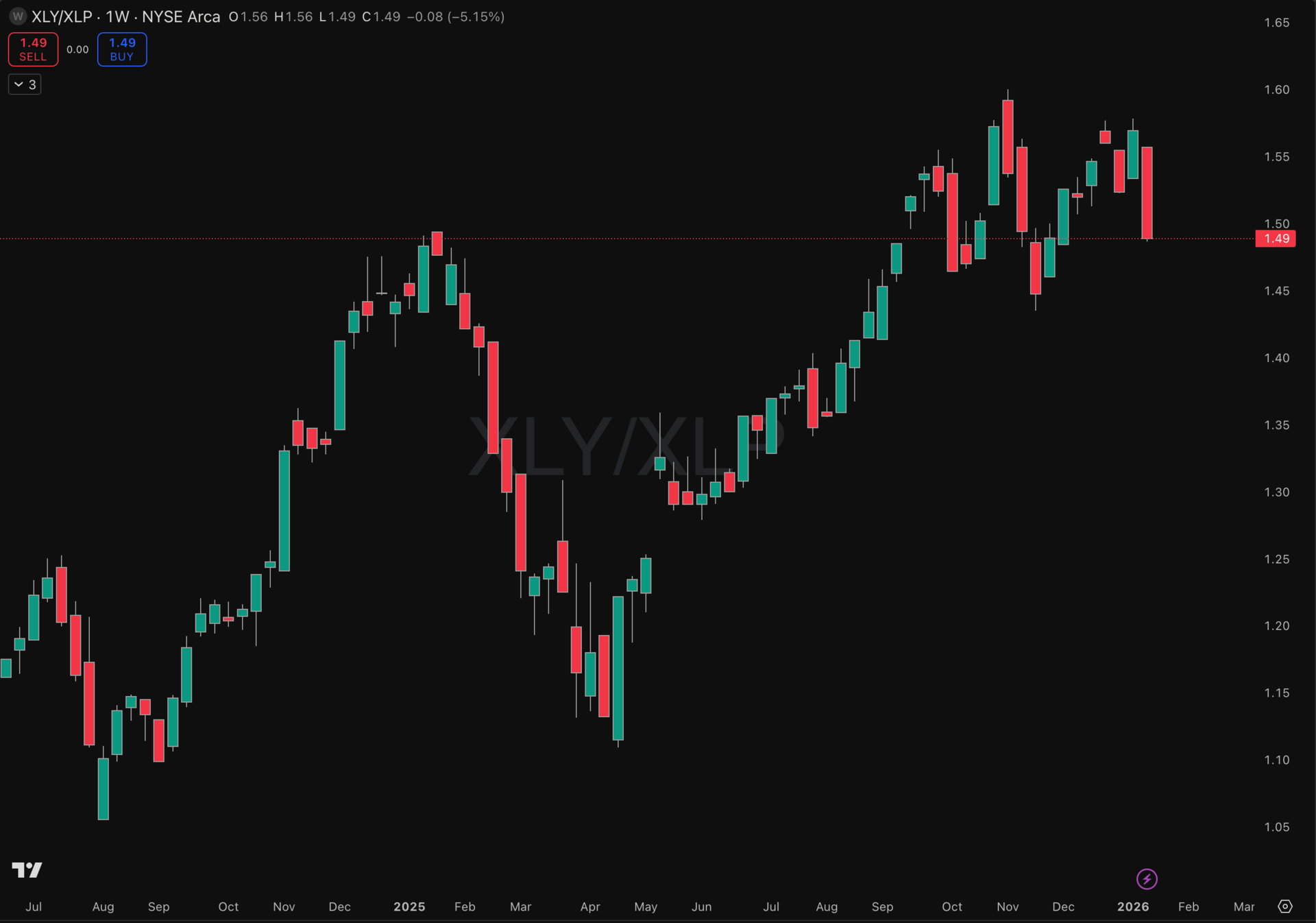

Greed Ratio (XLY/XLP) at 1.49. Down from 1.57. Defensive rotation underway, when cyclicals start losing to staples, someone's getting cautious. SPY down 0.35%, trend now "Falling." VIX at 15.86, up from 14.49. Not alarming. But complacency is fading.

Source: TradingView: Consumer Discretionary vs. Consumer Staples Ratio (XLY/XLP)

Now here's where it gets interesting. Breadth tells a different story:

S&P 500 % > 200 DMA: 67.1%. Up from 64%.

S&P 500 % > 50 DMA: 71.1%. Up from 70%.

NYSE % > 200 DMA: 71.3%. Up sharply.

Net Highs minus Lows: 181. Rising. Strong.

Breadth verdict technically reads "WEAK" due to A/D line divergence, 45 days or so since high. But look at those participation metrics. Improving underneath the price weakness. That's an important tell.

When prices fall while breadth improves, it often signals accumulation rather than distribution. Institutions buying while retail gets nervous. Doesn't guarantee anything. But it's the constructive interpretation.

Copper/gold at 0.00127 still flashing fear though. That divergence from equity markets hasn't resolved. See Issue #006 for why this matters.

Risk Appetite Score: 1 (Neutral) | Trend: ↑ | Rally Quality: High

China: Slowdown Flag Persists

China Score dropped to +1 from +2.

That slowdown flag from last week? Still active. FXI at 39.3, down slightly from 39.37. Deterioration continues, slow, steady, persistent.

Mixed signals across the board:

KWEB: 35.71, down 0.12.

Copper: 35.94, down 0.21.

USD/CNH: 6.9725 - yuan slightly stronger, small positive.

Caixin PMI: 50.1, barely expansion but holding

Caixin at 50.1 is the bull case. Manufacturing holding above the expansion threshold. But FXI declining while PMI holds? That divergence suggests equity investors see something the survey doesn't capture. Maybe margins compressing. Maybe credit stress beneath the surface. Maybe just years of disappointment breeding skepticism about policy effectiveness.

I've learned to respect what equity markets say about China versus what official data claims.

Global risk flags: 1 of 3 active. China Slowdown: ACTIVE. Yuan Stress: Clear. EM Contagion: Clear.

Spillover implications covered in Issue #006.

Signposts: Same Three, Deeper Risk

Same three signposts triggered. But one has pushed into more dangerous territory.

USD/JPY at 158. Up from 157.92.

Even deeper into intervention territory now. BoJ intervened at similar levels in 2022 and 2024. Risk of sudden yen reversal and the carry unwind that would follow has increased, not decreased.

When the yen reverses, it reverses hard. Global macro funds running carry trades get forced to unwind, sell risk assets to cover yen shorts. The cascade hits everything. August 2024 was the preview.

It can happen fast.

Alert Status: MULTIPLE TRIGGERS - Full Regime Review.

Transition Probabilities: Reflation Fades

This is the headline shift. Look at the Reflation row:

Regime | This Week | Last Week | Change |

Stay Current (Neutral/Chop) | 50% | 55% | -5% |

Goldilocks | 10% | 10% | — |

Reflation | 8% | 15% | -7% |

Late Cycle | 8% | 8% | — |

Stagflation | 3% | 3% | — |

Deflation/Crisis | 2% | 2% | — |

15% → 8%. Reflation odds nearly halved in one week.

That "Boom / Reflation" divergence implication driving last week's probability spike? Reversed. Framework no longer sees accelerating conditions. The heat that seemed so convincing seven days ago has dissipated.

Stay Current down to 50%. Coin flip on whether we exit this regime over the next four weeks. Half the probability mass sits elsewhere. The uncertainty is real, I'm not going to pretend otherwise.

Aggregate velocity: 0. No momentum either direction.

The system is coasting. Not driving.

Key Question: What Does Cooling Mean?

Last week I asked whether services growth could survive weak labor. That question remains unanswered, the data hasn't resolved it.

This week the question shifts. What does the cooling tell us?

Two interpretations. Both defensible.

First: healthy normalization. The ISM Services surge and GDPNow heat were overshoots. Markets and data often overshoot before finding equilibrium, it's the nature of complex systems. Policy and Risk Appetite returning to neutral is the framework recognizing that acceleration wasn't sustainable. Soft landing proceeds. Framework correctly filtered noise from last week's hotter readings.

Second: momentum loss before rollover. The cooling represents early stages of deceleration that eventually tips into Late Cycle. NFP weakness at 52k was the leading signal. Services strength was the lagging one. Greed Ratio shifting defensive is smart money positioning ahead of trouble.

We've seen that movie before. Breadth holds up until it doesn't.

Data doesn't clearly favor either interpretation. That's why conviction is minimal. That's why Stay Current probability is only 50%. I'm not going to manufacture certainty that doesn't exist.

What I'm watching:

Next ISM Services print. Does 54.4 hold, improve, or rollover? Services confirming boom versus fading toward 50, that's the fork.

NFP trend. 52k was concerning. Below 50k would be alarming. Recovery above 100k validates soft landing.

Breadth confirmation. Participation improving while price falls is potentially constructive. But A/D divergence needs to resolve. 45 days since high is extended.

USD/JPY at 158, testing intervention risk limits. BoJ has tools and has used them. Sudden reversal could cascade through carry trades quickly.

Cross-Asset Read

Regime: Neutral/Chop. Aggregate score: 0. Conviction: minimal.

Has anything materially changed from Issue #006? Not really. The framework's asset class readings remain largely unchanged. What shifted is the probability weighting. Reflation fading, Soft Landing reasserting not the underlying cross-asset logic.

Quick methodology recap on how the regime translates to asset classes:

Small Caps

Framework logic: Rate-sensitive, leverage-heavy, domestic-focused. In a soft landing with Fed easing, small caps typically catch a bid as floating-rate debt costs decline and risk appetite expands. In late cycle or recession, they underperform due to credit sensitivity and weaker balance sheets.

Current read: Breadth improving underneath suggests participation broadening. But NFP weakness and the services-labor divergence from Issue #006 remain unresolved. Framework sees setup without catalyst.

Gold

Framework logic: Responds to real rates, dollar direction, and tail-risk hedging demand. Signpost triggered (GLD >$300) reflects structural central bank accumulation and dollar weakness, not just speculation. In Neutral/Chop regimes, gold typically consolidates rather than trends.

Current read: Three currency signposts all point the same direction, dollar weak, safety bid present.

Rates

Framework logic: Duration benefits when growth weakens or inflation falls; suffers when both run hot. The pipeline model's "Disinflation - Pipeline Clearing" signal is marginally duration-positive. But growth stable at 0 provides no clear catalyst either direction.

Current read: 10-year at 4.166%, curve at 57 bps. No regime signal. Framework neutral on duration in Neutral/Chop is historically a range-trading environment for bonds.

Credit

Framework logic: Credit spreads are the "truth serum" they widen before equities crack in genuine risk-off episodes. HY at 271 bps says no stress. The validation system's Credit Check passes. Copper/gold divergence (fearful) vs. credit (calm) remains the unresolved tension flagged in Issue #006.

Current read: Spreads tighter week-over-week. No deterioration visible. Framework reads credit as confirming the "no imminent crisis" base case—but notes the divergence with industrial metals.

For detailed positioning logic and the services-labor tension analysis, see Issue #6. The framework interpretation there remains current.

What Would Change the View

Growth confirms boom: ISM Services above 55, NFP above 100k, copper/gold turns higher. Reflation path reopens.

Growth cracks: ISM Services below 50, NFP below 50k, Real Income turns negative. Late Cycle.

Inflation reaccelerates: Core PCE 3M annualized above 3.5%, Supercore reverses, 5Y5Y above 2.5%. Stagflation risk returns.

USD/JPY reverses: BoJ intervention or hawkish guidance. Moves below 152 trigger carry unwind.

Credit cracks: HY spreads above 400 bps. Currently 271, a long way off, but that's the confirmation level.

China deepens: FXI keeps falling, Caixin below 50. Global growth narrative weakens.

The Bottom Line

Regime: Neutral/Chop | Aggregate Score: 0 | Conviction: Minimal

Heat came off. Policy and Risk Appetite decelerated. The divergence that screamed "Boom / Reflation" last week now whispers "Soft Landing." Reflation probability got cut nearly in half.

Framework cooled. I think that's probably the right read.

This isn't bad news. It's normalization. System overheated on last week's ISM surge, now finding equilibrium. Underlying foundation remains: services expanding, financial conditions loose, disinflation progressing, credit calm.

Nothing has broken.

But margin for error has narrowed. Stay Current at 50% is a coin flip. Same three signposts triggered, USD/JPY pushing deeper into danger. China still wobbling. RRP buffer gone.

Cushions that would absorb a shock? Thinner than I'd like.

When the edge isn't clear, the disciplined move is to wait for clarity rather than manufacture conviction. Data will tell us which interpretation is right. Probably within the next few weeks.

Sometimes the best trade is the one you don't force.

See you next Sunday.

Questions or feedback? [email protected]

Disclaimer:

All content published by MacroAnalytix is for research and educational purposes only. Nothing in this publication should be interpreted as financial advice, investment recommendations, or a solicitation to buy or sell securities. You are solely responsible for your own financial decisions.