Regime Check: Same Score, Different Story

The regime hasn’t moved. The narrative has.

We’re still in Neutral/Chop—aggregate score +1, minimal conviction, 55% probability of staying put. Pillar scores look similar to last week. But the data underneath tells a story that doesn’t quite hold together.

ISM Services jumped to 54.4 from 52.6. That’s acceleration, not deceleration. GDPNow is tracking 5.1% for the current quarter—not soft landing territory, that’s boom. Yet NFP 3-month average slid to 52k from 59k. Labor is cracking while output accelerates. Those two things don’t usually happen at the same time.

Meanwhile, China just triggered the slowdown flag—FXI declining even as Caixin PMI holds above 50.

Last week the divergence check showed “Soft Landing.” Now it reads “Boom / Reflation.” That’s a meaningful shift in what the framework thinks is coming, even with the headline score unchanged. Transition probability for Reflation nearly doubled—from 8% to 15%.

MacroAnalytix Dashboard Scoring

Growth: The Divergence That Doesn’t Make Sense

This is the story of the week. Growth stays at 0 (Neutral), but what’s happening underneath matters more than the score itself.

ISM Services hit 54.4, up from 52.6. A 1.8 point jump putting services firmly in expansion. For an economy that’s 70% services, that carries weight.

ISM New Orders minus Inventories flipped from -1.5 to +2.5. A 4-point swing historically associated with manufacturing finding a floor. This ratio has been negative for months, first positive reading since the contraction began.

GDPNow is tracking 5.1% for the current quarter. Five percent. Atlanta Fed’s nowcast says the economy is running hot.

And then there’s the labor market, NFP 3-month average dropped to 52k.

That’s below the roughly 100k needed to keep pace with population growth. The weakness isn’t broad-based. Manufacturing shed 13k jobs in December. Retail lost 9k heading into Christmas, which is unusual. Temp staffing - the classic leading indicator - dropped for the eighth straight month. These are the sectors that crack first when companies pull back on hiring.

Unemployment ticked up to around 4.2–4.4% depending on the survey. Labor force participation held steady at 62.5% - no exodus from the workforce, just fewer jobs being created. The household survey, which sometimes diverges from payrolls, showed employment actually declining by 47k. When payrolls and household data disagree, pay attention.

How does 5.1% GDP happen with payrolls that can’t match demographics?

The divergence check reads “Aligned” with a “Boom / Reflation” implication - up from “Soft Landing” last week. Framework sees reflationary signals, not recessionary ones. But NFP weakness is the piece that doesn’t fit the puzzle.

Leading indicators (70% weight) score 0.3. Coincident indicators (30% weight) score 0.3. They’re aligned. But aligned on what? Output says boom. Labor says trouble.

Growth Score: 0 (Neutral) | Trend: → (Stable) | Divergence Implication: Boom / Reflation

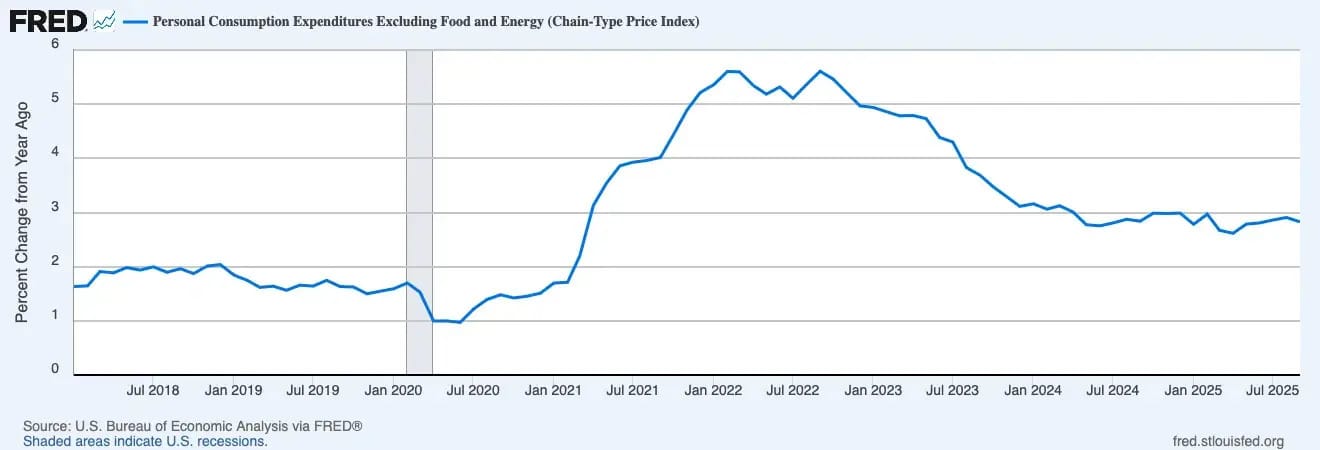

Inflation: Pipeline Progress Stalls

Last week the inflation pipeline showed “Disinflation Signal: YES – Pipeline Clearing.” This week all regime flags read “No.” No stagflation risk, no reflation signal, no disinflation signal. Momentum: Mixed.

Disinflation hasn’t reversed. It’s paused.

Upstream (20% weight, score 0.3): CRB Commodity Index accelerated to 378.22, scoring +1 on momentum. ISM Manufacturing Prices Paid flat at 58.5. Baltic Dry dropped to 1,688 from 1,882, shipping costs still falling. Mixed signals at the input level.

Midstream (25% weight, score 0): Expectations anchored. 5Y5Y forward at 2.24%, 10Y breakevens at 2.25%. Both stable, both in the Fed’s comfort zone. Bond market isn’t pricing inflation concerns.

Downstream (55% weight, score 0): Supercore PCE at 3.8%, the metric Powell watches closest, still moving the right direction. Atlanta Fed Wage Tracker at 4.2% but falling. But Core PCE at 2.82% has a wrinkle: 3-month annualized running at an estimated 3.2%, above the year-over-year rate. Near-term acceleration underneath the benign annual number.

Tariff pass-through monitor shows containment for now. Upstream commodities (DBC) up 5.72% YoY. Midstream PPI at 2.9%. Downstream Core CPI falling 0.41%. Pipeline not transmitting cost pressures to consumers yet.

Inflation Score: 0 (Stable) | Trend: ↓ | Pipeline Status: Paused

Policy: Both Levers Loose

Policy scores +1 (Accommodative) with an accelerating trend. Multiple tailwinds converging.

Financial conditions are loose. Chicago Fed NFCI at -0.55, well into accommodative territory. GS FCI at 98.5 and loosening. 10Y-3M spread at 56 bps - no recession signal.

Fiscal remains stimulative. Budget deficit at 5.9% of GDP is neutral, but fiscal impulse running 2.3% YoY. Government still adding demand.

Policy Mix Matrix flags what happens when both levers push the same way: “Both Loose = Bubble Risk.” When monetary and fiscal align, asset prices respond - sometimes faster than fundamentals warrant.

Policy Score: +1 (Accommodative) | Trend: ↑ (Accelerating)

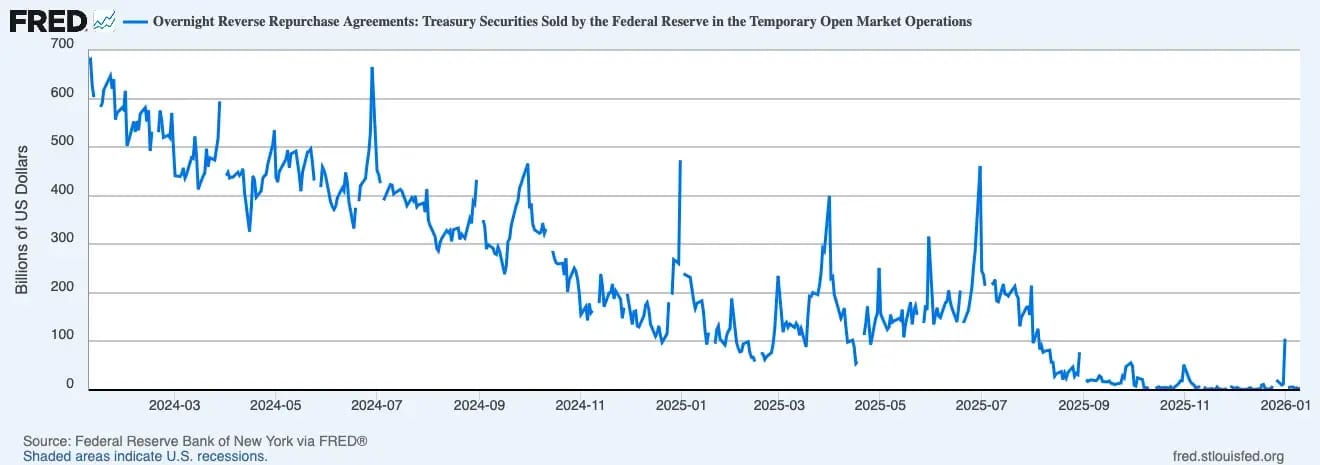

Liquidity: Buffer Gone Again - What Happens Next

Last week I noted the RRP buffer had recovered to $106 billion. This week: $3.28 billion.

Not a typo. The overnight reverse repo, the system’s shock absorber - drained again. $106B to $3B in a week. The buffer I said was back is essentially gone.

Why this matters: When RRP is flush, money market funds park excess cash there, keeping it out of the banking system. When it drains, that cash has to go somewhere - typically into T-bills or bank reserves. The problem is we’re running low on both cushions simultaneously. Bank reserves at $3.05T are adequate but not abundant. The RRP buffer that absorbed volatility in 2022-2023 is exhausted.

If funding stress emerges - say, around quarter-end or a Treasury settlement surge - there’s less slack in the system to absorb it. SOFR could spike. Repo rates could gap. The Fed’s reaction function in that scenario: expand the Standing Repo Facility, potentially accelerate T-bill purchases, or in extremis, pause balance sheet runoff. They have tools. But they’d be reacting, not preventing.

Broader picture: Fed balance sheet dropped $66 billion to $6,574B. TGA fell to $796 billion from $837B, a $41B decline is reserve-additive. Net liquidity at $5,774.72B, down $20.72B on the week.

Good news: plumbing stress remains normal for now. SOFR-repo at 10 bps, up from 8 but nowhere near December’s 35 bps stress levels. MOVE index at 66.9 - rates vol subdued. The strain hasn’t shown up in prices yet. But the buffer that would prevent strain from becoming stress is gone.

Dollar mixed. DXY recovered to 99.14 from 98.43—near 100 but still below. BTC at $90,667, falling in line with net liquidity.

Liquidity Score: 0 (Neutral) | Trend: ↓ | RRP Buffer: Nearly Exhausted

Risk Appetite: Rally Quality Holds

Risk Appetite stays at +1 (Risk-On), trend stable. Validation system green across all four checks.

SPY up 1.60%, rising trend. HY spreads tightened to 276 from 283 - credit calm. VIX at 14.49, complacent. Vol term structure in contango - no fear premium.

Greed Ratio (XLY/XLP) at 1.57 - cyclicals over defensives. IWM/SPY has smalls leading. QQQ/SPY has growth leading. Breadth metrics pointing the same direction.

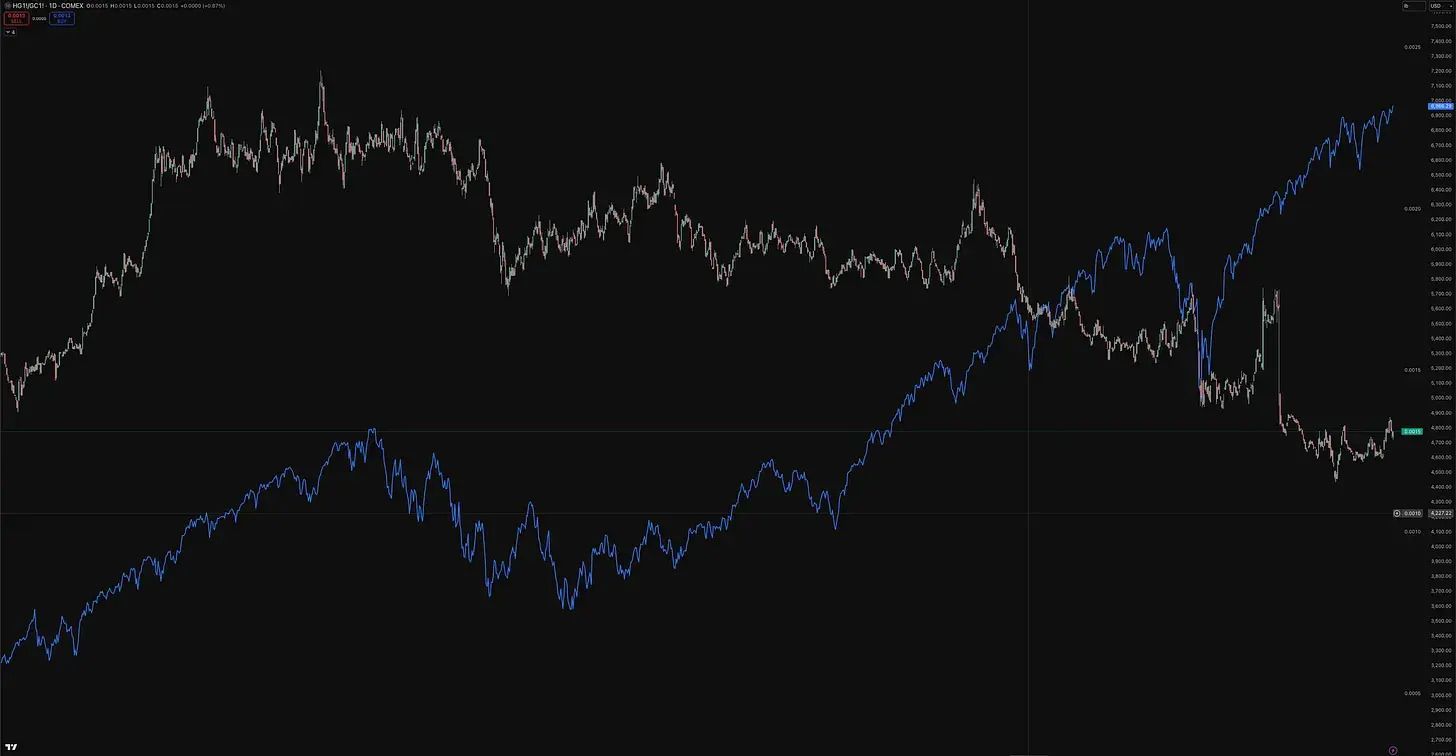

But copper/gold at 0.0013 keeps flashing fear. This ratio has a decent track record as a growth signal, when copper (industrial demand) leads gold (safety demand), risk assets tend to follow. When gold leads copper, trouble usually follows. The last time copper/gold diverged this sharply from equity markets was Q4 2018 and early 2020. Both preceded meaningful drawdowns. Not a perfect indicator, but when equities and industrial metals disagree this hard, one of them tends to be wrong.

Rally Verdict: HIGH QUALITY. All four checks pass. System says this rally is real. But the copper/gold divergence is the asterisk.

Risk Appetite Score: +1 (Risk-On) | Trend: ↑ (Stable) | Rally Quality: High

China: Slowdown Flag Triggered - Global Spillovers

Last week China looked like a bright spot. FXI rising. Caixin PMI above 50. “Good Rise” pattern - yields up, FXI up - suggested stimulus gaining traction.

This week the slowdown flag triggered.

FXI dropped 0.47 to 39.35, now showing -1.18% trend that hit the slowdown condition. China Score still +2 on a -5 to +5 scale, but direction shifted.

Other China indicators are mixed. KWEB up 0.2 to 35.83. Copper (CPER ETF) rose 1.17 to 36.15, triggering “Expansion.” Caixin PMI at 50.1 still above water. USD/CNH at 6.9767, yuan stress clear.

Copper says expansion, FXI says slowdown, PMI says barely holding. Something has to give.

Why it matters beyond China: If this slowdown deepens, the spillovers hit in predictable places. Commodity exporters - Australia, Brazil, Chile - get squeezed on volumes and prices. Industrial metals face demand headwinds just as copper was starting to stabilize. EM currencies with China trade exposure (KRW, TWD, MYR) would feel pressure. The Baltic Dry Indec already dropped 11% - shipping demand softening is often the first signal.

For US assets, China weakness historically cuts both ways. It’s disinflationary (lower commodity prices, cheaper imports), which helps the Fed. But it’s also a growth headwind for multinationals with China revenue exposure - think industrials, materials, luxury goods. And if China’s slowdown triggers EM stress, risk-off flows could hit US equities even without direct China exposure.

Global risk flags: 1 of 3 active. China Slowdown: ACTIVE. Yuan Stress: Clear. EM Contagion: Clear - for now.

Signposts: Same Three Triggered

Same three from last week:

USD/JPY at 157.92 (trigger: above 152) - TRIGGERED. Carry unwind risk elevated. Yen weakening toward multi-decade extremes. BoJ intervention risk remains.

DXY at 99.14 (trigger: below 100) - TRIGGERED. Dollar weakness persists despite bounce from 98.43.

Gold (GLD) at $414.47 (trigger: above $300) - TRIGGERED. Safety bid and dollar concerns. Central bank buying structural.

All three pointing the same direction: dollar weakness plus safety bid. That combination doesn’t usually happen together. Something structural may be shifting. Dashboard flags “REVIEW REGIME NOW” until they clear.

Transition Probabilities: Reflation Odds Jump

Notable shift in the probability matrix:

55% Stay Current (Neutral/Chop) – unchanged

15% Reflation – up from 8%

10% Goldilocks – unchanged

8% Late Cycle – unchanged

3% Stagflation – unchanged

2% Deflation/Crisis – unchanged

Reflation nearly doubled. Divergence implication shifted to “Boom / Reflation.” ISM Services surging. GDPNow at 5.1%. New Orders minus Inventories flipping positive. Framework reading hot economy signals.

Aggregate velocity +1, driven by Policy acceleration. Other pillars remain stable. That asymmetry creates the reflation tilt.

Key Question: Can Services Growth Survive Weak Labor?

This is the tension at the heart of the data. ISM Services at 54.4 says services accelerating. GDPNow at 5.1% says output booming. NFP at 52k says employment cracking.

How do you get boom-level growth without job creation?

Three possibilities:

1. Productivity surge. AI and automation driving output without corresponding labor input. Would be genuinely bullish - higher growth, less inflation pressure, margin expansion. The 90s tech boom showed this can happen.

2. Data resolves to reality. GDPNow tracks current quarter from high-frequency data. Labor tells you the recent past. If services growth is real, employment should catch up. If labor is the true signal, ISM rolls over.

3. Measurement error. One series is wrong. BLS has acknowledged survey response issues. GDPNow could be overfitting volatile components. When data conflicts this sharply, humility about precision is warranted.

What concerns me: labor usually runs coincident-to-lagging. When it weakens, the economy is typically already in trouble. NFP at 52k alongside 5.1% GDP is unusual. Either we’re in a new regime where this relationship breaks, or one signal is about to reverse.

Real Income ex-Transfers at 1.8% is the household check. Positive, cushion exists. But if labor weakness persists and income slows, spending follows. Services need consumers with jobs.

The bull case: policy accommodative, conditions loose. If labor softness reflects caution rather than collapsing demand, easier conditions could unlock hiring. ISM surge suggests demand is present.

New Orders minus Inventories flipping positive matters. That indicator led the 2023 manufacturing recovery by about 4 months. If signaling now, employment should follow with a lag.

Base case: Divergence resolves in 4-6 weeks. Either services stays strong and labor catches up (Goldilocks path), or labor weakness drags services down (Late Cycle path). Current state is unstable.

Cross-Asset Read

Regime says Neutral/Chop, minimal conviction. Asset allocation lookup: Equities Quality Only, Bonds Neutral, Commodities Neutral, FX Neutral, Vol Neutral.

But the Reflation probability jump (8% → 15%) and “Boom / Reflation” implication point to where edge might develop.

Small Caps (RTY/IWM)

Issue #005 thesis intact, strengthening. IWM/SPY showing smalls leading. Policy accommodative, rate-sensitive names benefit. ISM surge supports domestic-focused companies. “Boom / Reflation” historically favors small over large.

Counter: NFP at 52k means labor weakening, and small caps are more labor-intensive. If employment crack is real, smalls get hit harder.

Gold (GC/GLD)

Still triggered above $300. Structural case holds: dollar weakness, central bank buying. GLD at $414.47. Same note from Issue #005 - extended above moving averages, pullbacks offer better entries than chasing.

Rates (ZN/TLT)

10-year at 4.176% in no-man’s land. Not cheap enough to buy, not rich enough to short. 10Y-3M at 56 bps flat - no signal either direction. If Boom/Reflation plays out, duration loses. If labor weakness wins, duration rallies. Framework says Neutral.

Copper (HG)

Copper/gold at 0.0013 flashing fear. But copper itself rose 1.17 to 36.15, triggering “Expansion” in China monitor. Ratio says fear, move says growth. Until ratio turns, growth trade lacks confirmation.

What Would Change the View

Growth cracks: ISM Services below 50, Real Income negative, NFP below 50k - Late Cycle.

Growth confirms boom: NFP recovers above 100k, ISM stays above 54, copper/gold turns higher - Reflation.

Inflation reaccelerates: Core PCE 3M annualized above 3.2%, Supercore reverses, 5Y5Y above 2.5% - Stagflation risk.

USD/JPY reverses: BoJ intervention or hawkish guidance. Watch moves below 152.

Credit cracks: HY above 400bps. Currently 276bps - a long way off.

China deepens: FXI keeps falling, Caixin below 50, yuan stress triggers. Slowdown flag just fired - if it persists, global growth weakens.

The Bottom Line

Regime: Neutral/Chop | Policy accommodative, risk appetite positive, growth diverging, inflation paused, liquidity draining.

Score didn’t move. Data underneath moved a lot.

The divergence is the story. ISM Services 54.4 and GDPNow 5.1% say boom. NFP 52k says crack. They don’t reconcile. Either one is wrong, or output and employment are decoupling in ways we haven’t seen before. Next 4-6 weeks will tell.

Reflation odds nearly doubled to 15%. Framework adjusting to hot output data. But 55% on Neutral/Chop means no decisive catalyst yet.

Three signposts still triggered. USD/JPY, DXY, gold. Currency cluster hasn’t cleared.

China slowdown flag active. FXI declining. Spillovers to commodities and EM worth watching.

RRP buffer gone again. $106B to $3.28B. Shock absorber drained. Plumbing stress normal, but cushion is gone - next funding squeeze hits reserves directly.

Conviction is minimal. When data diverges this sharply, the honest read is: I don’t know which way this resolves. The next few weeks should tell us.

See you next Sunday.

Questions or feedback? [email protected]

Disclaimer: All content published by MacroAnalytix is for research and educational purposes only. Nothing in this publication should be interpreted as financial advice, investment recommendations, or a solicitation to buy or sell securities. You are solely responsible for your own financial decisions.