The regime just flipped. And not in a good way.

Four weeks ago, we launched with Reflation - growth positive, inflation sticky, policy restrictive. Last week, we flagged Late Cycle concerns as liquidity deteriorated. This week? The dashboard is flashing Stagflation. The one regime nobody wants to see.

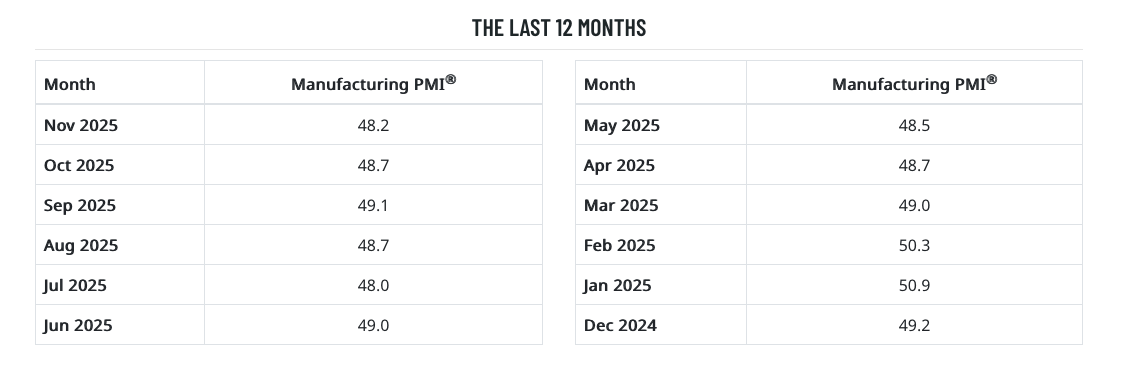

Growth has turned contractionary. Not slowing - contracting. ISM Manufacturing stuck at 48.2. Initial claims ticking higher. The Conference Board Leading Index down 2.1% over six months. The composite growth score has flipped negative for the first time since we started publishing.

MacroAnaltix Dashboard Scoring

Current Regime: Stagflation Weighted Score: 1.219 (down from 1.92) | Triggered Signposts: 4

Four Recession Signposts Triggered Simultaneously

Here’s the thing: four signposts have triggered simultaneously. This isn’t normal.

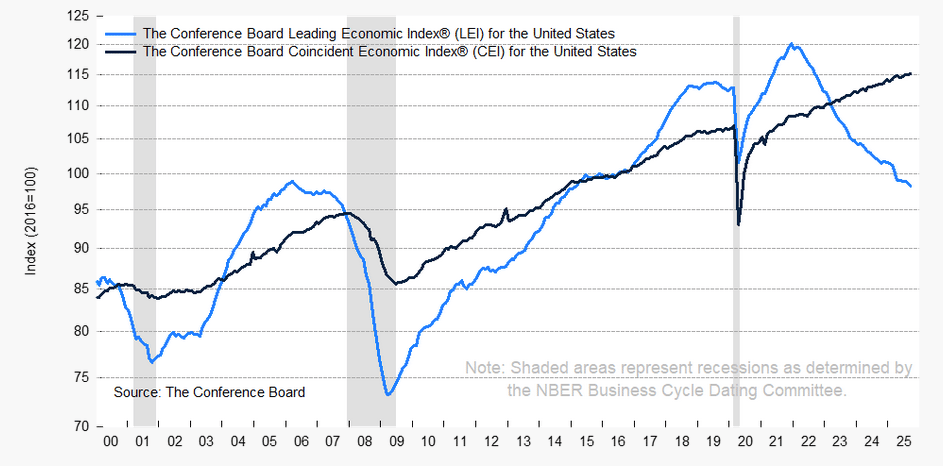

1. Conference Board LEI Negative (-2.1%)

The Conference Board Leading Economic Index is down 2.1% over six months—flashing the classic recession warning.

Historical track record: - Negative readings of this magnitude have preceded every recession in the modern era - Typical lead time: 6-12 months - False positives: 2016, 2019 (economy avoided recession) - Current signal: Elevated recession probability, not certainty.

2. Yield Curve Uninversion (2s10s at +67bps)

The 2s10s curve has uninverted to +67 basis points—historically a recession confirmation signal.

Source: https://fred.stlouisfed.org/series/T10Y2Y# (Recession Shading)

What curve uninversion means: - The curve inverted in 2022-2023, signaling recession risk - Now it’s uninverted—sharply - The uninversion signal has preceded recessions in 7 of the last 8 cycles - Lag ranges from 2 months (2001) to 22 months (2007) - We’re in that window, but timing precision is low.

3. Overnight RRP Exhausted ($0)

The overnight reverse repo facility has been completely drained.

Why this matters: - RRP was the system’s shock absorber - Excess cash parked at the Fed provided a liquidity buffer - That buffer is now gone - Future funding stress will hit bank reserves directly - Relevance is conditional: matters if stress materializes.

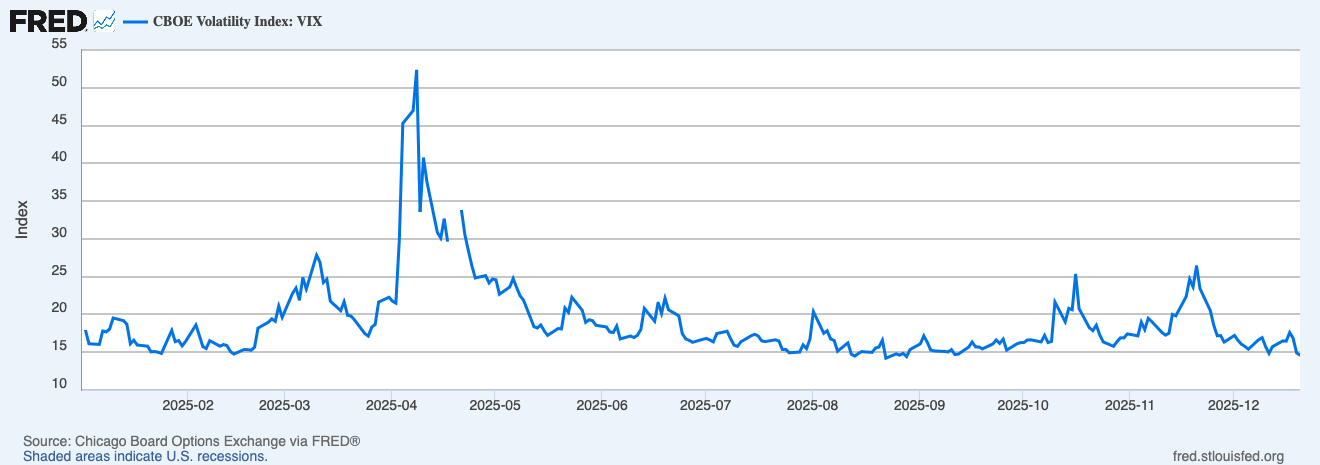

4. VIX Below 15 (Complacency Signal)

The VIX is sitting below 15, pricing in a world where none of this matters.

The tension: - VIX below 15 isn’t inherently wrong. Post-2010 average is ~17 with extended calm periods - But VIX below 15 while leading indicators flash warnings creates elevated spike risk - The last three instances of VIX <15 with negative LEI saw volatility double within 6 months - Low VIX means protection is cheap. That’s information worth noting.

Copper Gold Ratio at 0.0063: Fear Signal Explained

The copper/gold ratio (HG ÷ GC futures) at 0.0015 is flashing fear, and is currently sitting at its lowest level since November 1993.

What the ratio tells you: - Copper = Industrial metal, growth-sensitive - Gold = Safe haven, fear trade, real rate play - Low ratio = Gold outperforming copper = Markets pricing fear over growth.

When copper/gold is this depressed, it’s telling you global growth expectations are weak. The ratio often leads equity weakness by 2-3 months historically.

Conference Board LEI Recession Indicator: Historical Context

At -2.1% over six months, the LEI is flashing its classic recession warning.

The LEI components (10 indicators): - Average weekly hours in manufacturing - Initial unemployment claims - New orders for consumer goods - ISM new orders index - New orders for capital goods - Building permits - Stock prices (S&P 500) - Credit conditions - Interest rate spread (10Y-Fed Funds) - Consumer expectations

Historical accuracy: - Has preceded every recession since 1960 - Typical lead time: 6-18 months - Notable false positives: 2016 (China slowdown fears), 2019 (trade war) - Current reading: Most negative since 2020.

Growth Pillar Breakdown: Why It Flipped Negative

The growth pillar just flipped negative. First time since we launched. This one matters.

ISM Manufacturing: 48.2 for the tenth consecutive month below 50. New orders minus inventories at 48.9 is the one bright spot, suggesting the contraction may be bottoming.

Initial Claims: Stable at 217,000 on the four-week average, historically low, but moving wrong direction from 208,300.

Retail Sales: Decelerated to 3.3% year-over-year from 3.9% in September. The consumer isn’t cracking, but definitely slowing.

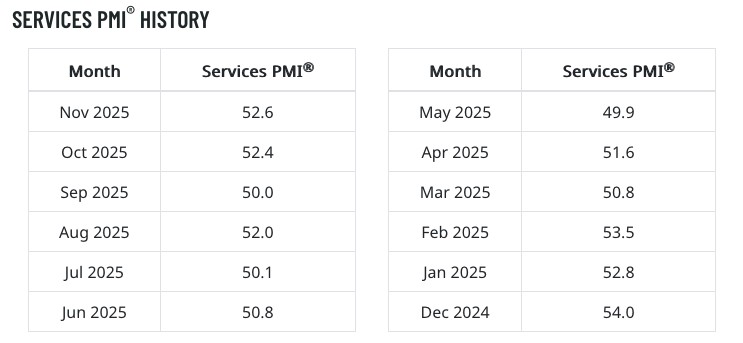

ISM Services: 52.6 is the saving grace. Services represent ~70% of the economy and are still expanding, but barely.

Atlanta Fed GDPNow: 3.5% seems to contradict the growth downgrade. But GDPNow is backward-looking. The regime framework weights leading indicators to identify where we’re heading.

Growth Score: -1 (Contractionary) | This is the most significant regime shift since we started publishing.

Core PCE vs Core CPI: Limited Visibility

Not much new to work with here. The government shutdown wiped out key data, and the prints we do have are stale. Core PCE sits around 2.8%, Core CPI around 3.3% - both unchanged from prior readings in any meaningful way.

The divergence between the two measures persists, but without fresh data it's hard to know whether that gap is narrowing or widening. The Fed watches PCE; markets watch CPI. Right now, neither is telling us anything we didn't already know.

Cross-Asset Implications for Stagflation Regime

Stagflation changes everything. Growth negative, inflation positive, liquidity tight, this is the toughest configuration historically.

Gold

Gold is the classic Stagflation beneficiary historically. Inflation elevated, real rates potentially falling as Fed is forced to ease, uncertainty rising. GLD inflows were positive this week while most everything else saw outflows.

The structural case: central bank buying, reserve diversification. The tactical observation: regime uncertainty.

Cyclical Assets

Stagflation is historically the worst regime for equities. Growth slowing while input costs remain elevated compresses margins.

Small caps and cyclicals historically face the toughest backdrop when liquidity is tightening and growth is negative.

Defensives

Utilities and staples historically provide relative stability in Stagflation. Companies with pricing power, stable cash flows, and dividend support tend to hold up better.

Dollar

Stagflation is historically dollar-positive. When global growth weakens and uncertainty rises, capital tends to flow to the reserve currency.

Regime Signposts: What Would Change the View

Growth stabilizes: ISM Manufacturing above 50 or ISM Services above 54 flips growth back to neutral. Moves from Stagflation toward Reflation.

Inflation breaks lower: Core PCE at 2.5% or below shifts inflation to neutral. Stagflation becomes Disinflation—historically constructive.

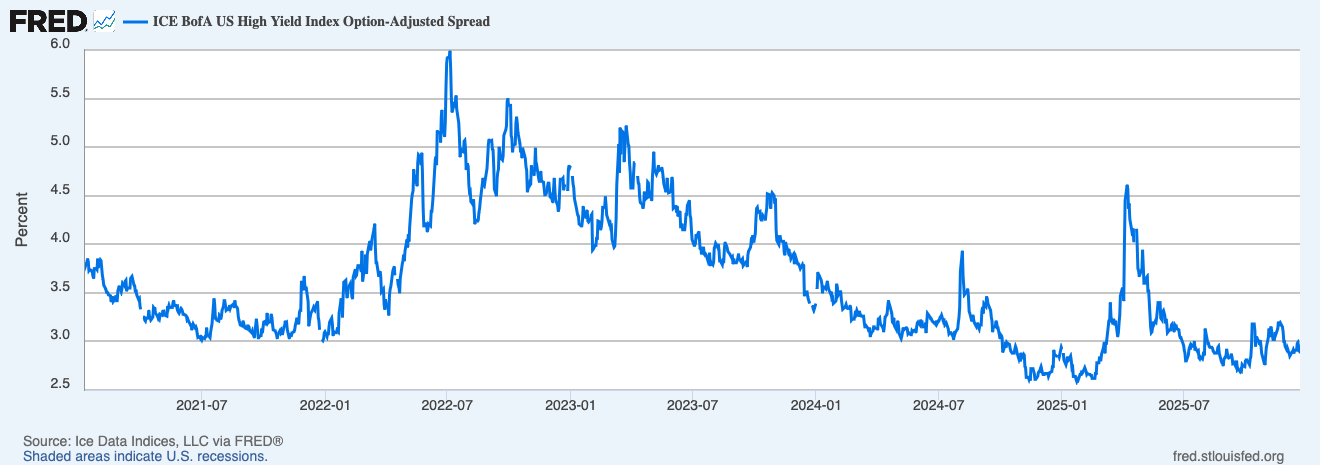

Credit cracks: HY spreads above 400bps confirms recession signal. Currently 290bps.

VIX spikes above 25: Complacency signpost clears. Paradoxically, that historically makes setups more interesting—elevated fear tends to precede better opportunities.

The Bottom Line

Current Regime: Stagflation | Growth negative, inflation elevated, four signposts triggered.

The regime historically favors defensives and gold over cyclicals. Risk reduction makes sense when four signposts trigger simultaneously, that’s not normal.

VIX below 15 creates elevated spike risk. Protection is cheap.

Frameworks have limitations. The bull case - services holding, CPI improving, AI/fiscal tailwinds, credit calm - is legitimate. Markets could be right and indicators wrong.

Questions or feedback? [email protected]

Disclaimer: All content published by MacroAnalytix is for research and educational purposes only. Nothing in this publication should be interpreted as financial advice, investment recommendations, or a solicitation to buy or sell securities. You are solely responsible for your own financial decisions.