Dashboard Methodology Upgrade: Version 8.1 Explained

Before we dive into the regime read, a note on methodology. Over the holidays, I rebuilt the MacroAnalytix dashboard from v1 to v2. This wasn’t cosmetic, it fundamentally changes how we assess the macro environment.

The old dashboard had a problem: it was too binary. Growth at 0.1 scored the same as Growth at 0.9. Inflation ticking from 2.7% to 2.8% could flip the entire regime classification.

V2 introduces three structural improvements:

1. Buffer Zones Prevent Regime Whipsaw

The regime matrix now uses ±0.5 buffer zones to classify Growth and Inflation states. A raw score between -0.5 and +0.5 is now classified as Stable, not forced into Rising or Falling.

Why this matters: In Issue #004, Growth scored -1 and Inflation scored +1 = Stagflation. Today, both score 0 = Neutral/Chop. The buffer zones ensure we don’t flip regimes on marginal moves.

2. Leading vs Coincident Indicator Weighting (70/30)

The old Growth pillar weighted indicators with fixed percentages without distinguishing predictive value.

V2 splits Growth into: - Leading indicators (70% weight): ISM New Orders - Inventories, building permits, copper/gold - Coincident indicators (30% weight): Real income, industrial production, services PMI

When leading and coincident agree, you have high conviction. When they diverge, something has to give. Right now, the divergence check shows Aligned with a Soft Landing implication.

3. Inflation Pipeline Model: Upstream → Midstream → Downstream

The old Inflation pillar tracked indicators with simple weights, no distinction between where pressures originate and where they show up.

V2 implements a three-stage pipeline: - Upstream (20%): Commodities, shipping costs (CRB Index, Baltic Dry) - Midstream (25%): Market expectations (5Y5Y breakevens, 10Y breakevens) - Downstream (55%): Sticky services (Supercore PCE, wage growth, Core PCE)

Current read: Upstream stable, midstream anchored, downstream decelerating. Regime flag: Disinflation Signal: YES — Pipeline Clearing.

Regime Scorecard: Stagflation to Neutral/Chop

The storm passed. Now comes the fog.

Two weeks ago, the dashboard was flashing Stagflation. Four signposts had triggered. This week: all four of those signposts have cleared. The regime has flipped from Stagflation to Neutral/Chop.

But three new signposts have triggered: USD/JPY above 152, DXY below 100, and GLD above $300. All three point to dollar weakness and carry unwind risk.

MacroAnalytix Dashboard Scoring

Current Regime: Neutral/Chop Aggregate Score: +1 | Conviction: Minimal

USD/JPY Carry Unwind Risk at 157: Why It Matters

USD/JPY above 152 (current: 156.80) triggers our carry unwind signpost.

What carry unwind risk means: The yen is weakening to multi-decade extremes. Leveraged positions in higher-yielding currencies build up. When yen reverses, these positions unwind violently, the Bank of Japan has intervened at similar levels before.

August 2024 precedent: EEM dropped 8% in three sessions. EM FX volatility spiked from 8 to 14. MXN, BRL, ZAR particularly exposed given carry characteristics.

Trigger to watch: USD/JPY breaking below 152 with momentum, or BoJ intervention headlines.

DXY Below 100: Dollar Weakness Signal

DXY at 98.43 has broken below the psychological 100 level, triggering our second signpost.

Implications of dollar weakness: Typically commodities-positive, EM-positive (dollar-denominated debt becomes easier to service). Signals global liquidity conditions easing in dollar terms but also means dollar assets relatively less attractive.

The tension: Dollar weakness is typically risk-on. But combined with gold strength and carry unwind risk, it suggests something more structural, either reserve currency revaluation or positioning for correlation breakdown.

Copper Gold Ratio at 0.0015: Still Flashing Fear

The copper/gold ratio (HG/GC) at 0.0015 remains at it’s lowest level since Nov 1993.

What it’s telling us: Gold says fear and safety, Copper says no growth bid. When they diverge this hard, something has to give.

China improving but copper not confirming: FXI rising, Caixin PMI above 50, but copper/gold skeptical. Until the ratio turns, growth-sensitive analysis lacks confirmation.

SOFR-Repo Spread Normalized: Plumbing Fixed

SOFR-repo spreads collapsed from 35bps to 4.8bps, a 30 basis point normalization in weeks. The year-end funding stress didn’t materialize.

What fixed it: Fed’s T-bill buying program worked, year-end funding pressures absorbed, money markets functioning normally.

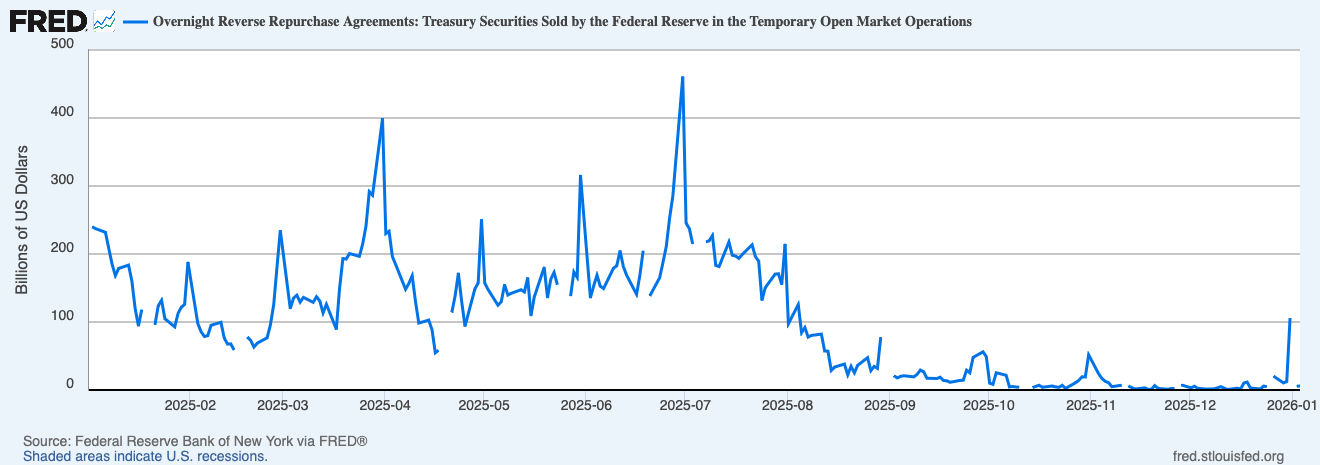

What it didn’t fix: Overnight RRP buffer still low (recovered to $106B currently at $5.6B). TGA still elevated at $500B, Fed balance sheet still contracting at -12% YoY - Net liquidity still draining.

Liquidity Score: 0 (Neutral) | The acute stress passed. Structural drain continues.

Transition Probability Matrix: Where We’re Heading

V2 now calculates where we’re likely heading based on score velocity, acceleration, and historical patterns.

Current transition probabilities

55% Neutral/Chop (stay current)

10% Goldilocks

8% Reflation

8% Late Cycle

3% Stagflation

2% Deflation

What 55% probability means: Not a vote of confidence, it’s acknowledgment that the framework doesn’t see a clear directional catalyst. The remaining 45% isn’t symmetric to the upside.

Cross-Asset Implications for Neutral/Chop Regime

The regime says Neutral/Chop with minimal conviction. The signal validation shows HIGH QUALITY rally conditions (4/4 checks pass), but the regime itself is directionless.

Small Caps

Why small caps are worth watching in this regime: IWM above all moving averages, ribbon score 3.5 (Strong Up). IWM/SPY ratio signaling risk-on with smalls leading. Growth divergence check shows ‘Aligned’ with ‘Soft Landing’ implication. Rate sensitivity works in favor when Fed has room to ease.

What would challenge the thesis: ISM Services below 50, growth divergence flipping to ‘Diverging’, breadth deterioration.

Gold

The structural case: Dollar weakness (DXY below 100). Falling real rates as Fed pauses. Central bank buying persistent. Geopolitical hedging structural.

The tactical observation: Extended above moving averages. Pullbacks historically offer better setups than chasing extended moves.

EUR/USD

The thesis from Issue #003 targeted 1.19-1.20. At 1.17, that thesis is playing out as expectated.

The methodology point: When a thesis completes, recognize it. Analysis differs from hope.

Where the Framework Shows No Clear Direction

Rates: 10-year fairly valued, neither cheap nor expensive by historical standards.

Copper: The copper/gold ratio isn’t confirming growth. Until it turns, analysis lacks confirmation.

Crude: No signposts triggered either direction. When the framework is silent, that’s information.

Inflation Pipeline Analysis

The v8.1 inflation pipeline model shows genuine progress:

Upstream (20% weight)

CRB Commodity Index at 374.51 - accelerating but manageable.

Baltic Dry Index collapsed to 1,877 - shipping costs normalizing.

Midstream (25% weight)

5Y5Y Forward Inflation at 2.3% - anchored

10Y Breakevens at 2.25% - stable.

Downstream (55% weight)

Supercore PCE at 3.8% - decelerating (down from 4%)

Atlanta Fed Wage Tracker at 4.2% - falling

Core PCE at 2.8% - stable

Regime flag: Disinflation Signal: YES — Pipeline Clearing.

Regime Signposts: What Would Change the View

Growth deteriorates: ISM Services below 50, Real Income ex-Transfers negative, NFP 3-month average softening further. Shifts toward Late Cycle.

Inflation reaccelerates: Core PCE above 3.0% or Supercore reversing downtrend. Back toward Stagflation risk.

USD/JPY reverses violently: BoJ intervention triggering carry unwind. Cascades through risk assets regardless of fundamentals.

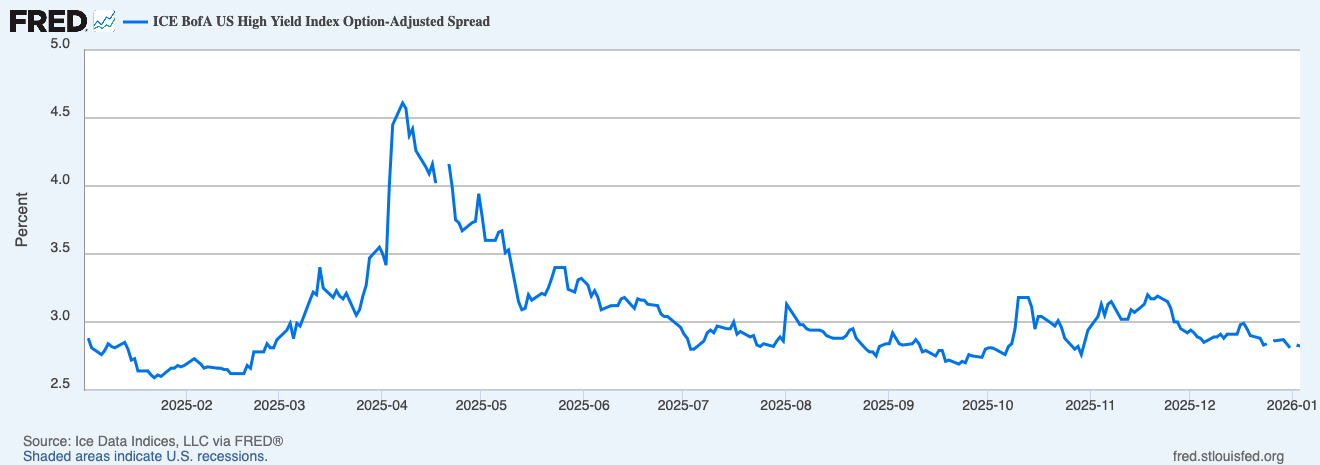

Credit cracks: HY spreads above 400bps. Currently 283bps.

China confirms upturn: FXI rising, Caixin above 50, copper/gold recovering. Supports transition to Goldilocks.

The Bottom Line

Current Regime: Neutral/Chop | Growth neutral, inflation stable, policy neutral, liquidity normalized. Only risk appetite positive.

The Stagflation scare from two weeks ago? Over. But don’t get comfortable. Neutral/Chop is an unstable equilibrium. The path to Late Cycle is shorter than the path to Goldilocks.

Conviction is minimal. Signal strength is zero. The framework doesn’t see a clear directional catalyst.

Three signposts triggered: USD/JPY, DXY, Gold all point to dollar weakness and carry unwind risk. These will tell us which way the fog clears before headlines do.

The framework is getting sharper, but sharper doesn’t mean infallible.

Questions or feedback? [email protected]

Disclaimer: All content published by MacroAnalytix is for research and educational purposes only. Nothing in this publication should be interpreted as financial advice, investment recommendations, or a solicitation to buy or sell securities. You are solely responsible for your own financial decisions.