Regime Scorecard: Reflation With Restrictive Policy

Welcome to the first edition of The Setup.

The macro regime framework is built on five pillars: Growth, Inflation, Policy, Liquidity, and Risk Appetite. This week’s assessment shows classic late-cycle Reflation - ISM Services strength carrying the economy while Core PCE inflation remains sticky above target and real Fed Funds stay restrictive despite 50bps of cuts.

MacroAnalytix Dashboard Scoring

Current Regime: Reflation / Goldilocks Aggregate Score: +1

The tension is real: can the economy sustain expansion with Core PCE inflation still above 2.5% and real Fed Funds rates positive? History says this configuration doesn’t last. Either growth cracks, inflation cools, or the Fed blinks.

ISM Services vs Manufacturing: The Two-Speed Economy Explained

Growth is expanding, but the ISM Services vs Manufacturing divergence tells the real story.

ISM Services printed 56.0 in October - up from 54.9 in September. That’s not just expansion, that’s acceleration. The highest reading since July 2024 signals genuine momentum in the dominant part of the economy.

ISM Manufacturing printed 46.5 - the seventh consecutive month below 50. New orders are soft, production is contracting, factory employment is shrinking.

Here’s the thing: manufacturing is only 11% of GDP. Services, the other 89% are carrying the economy. This ISM services manufacturing divergence creates a two-speed economy: goods weak, services strong.

At some point, manufacturing weakness could bleed into hiring and investment. But right now, services momentum is overwhelming that risk. Atlanta Fed GDPNow tracking 2.5% for Q4 confirms the growth picture remains solid.

Growth Score: +1 (Expansionary) | Trend: → | Key Level: ISM Services below 50 would collapse this thesis

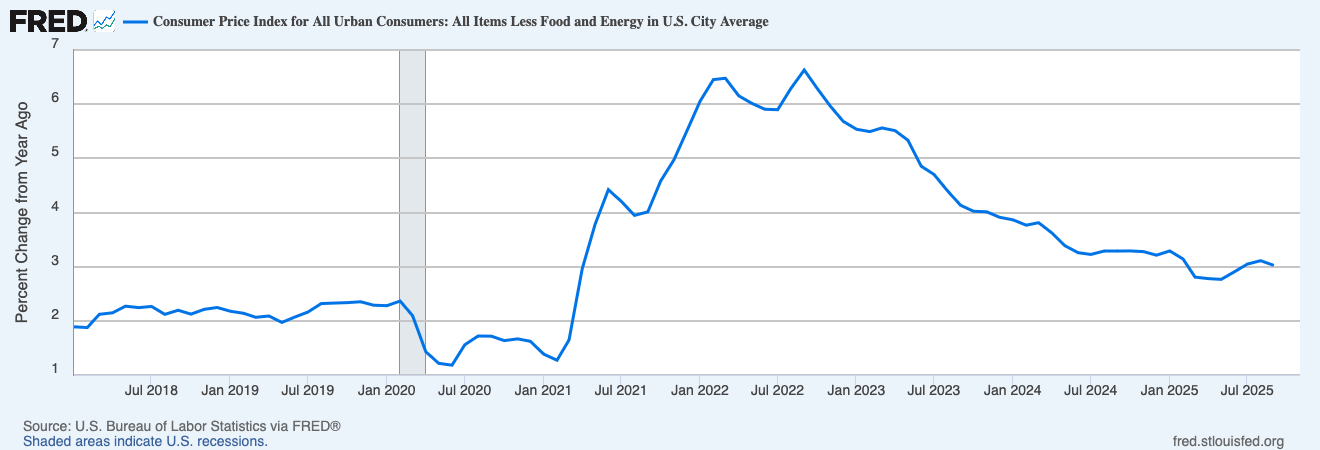

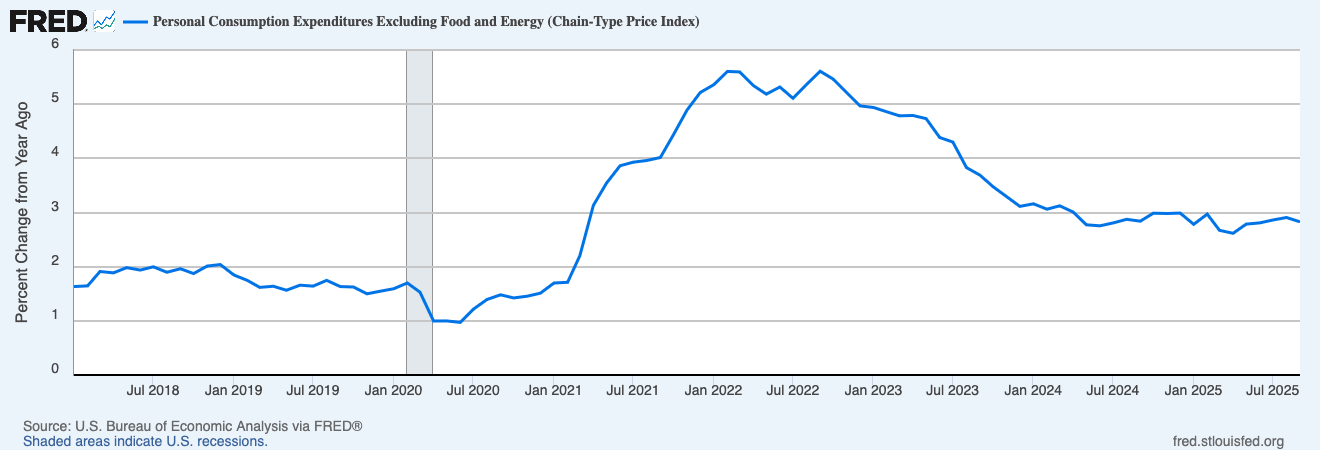

Core PCE vs Core CPI: Inflation Is Rising, Not Falling

Core PCE inflation sits at 2.8%, up 0.1 percentage points from prior month. Core CPI is at 3.3%. Both readings are well above the Fed’s 2% target, and the trend is pointing higher.

This is the problem nobody wants to talk about.

The market narrative has been “inflation is coming down, the Fed can ease.” The data says otherwise. The ISM Services prices paid component hit 70 in October - the highest since October 2022. Businesses are flagging cost pressures that extend beyond tariffs.

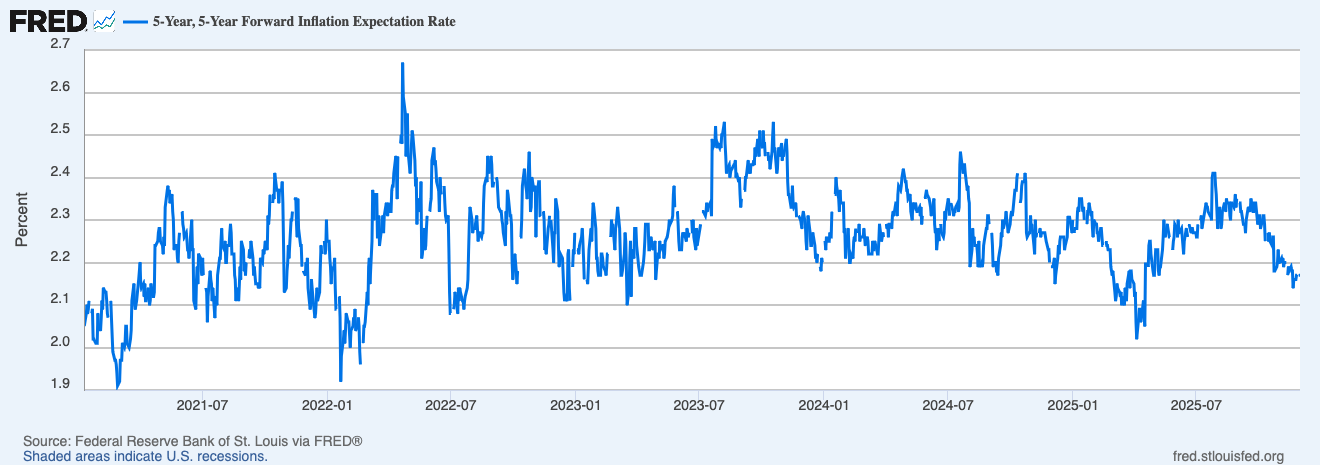

Market-based inflation expectations remain anchored. The 5-year 5-year forward breakeven sits at 2.17%, suggesting long-term expectations haven’t unmoored. But realized Core PCE inflation is moving the wrong way.

Inflation Score: +1 (Rising) | Trend: ↑ | Key Level: Core PCE above 3.0% becomes the dominant macro story.

Real Fed Funds Rate Calculation: Policy Is Still Restrictive

The Fed cut 25bps in September and another 25bps in November, bringing the target range to 4.50-4.75%. They announced the end of quantitative tightening effective December 1. Sounds dovish.

But the real Fed Funds rate tells a different story.

Real Fed Funds = Nominal Fed Funds minus Core PCE Inflation

At 4.50-4.75% nominal minus 2.8% Core PCE, real Fed Funds sit around +1.7% to +1.9%. That’s positive real rates. That’s restrictive territory.

The Fed has eased 50bps total from the peak, moving from “very restrictive” to “moderately restrictive.” They haven’t shifted to accommodative. Markets pricing 75-85% odds of another December cut may be underestimating how sticky Core PCE inflation complicates that path.

Policy Score: -1 (Restrictive) | Trend: → | Key Level: Real Fed Funds approaching zero would signal accommodative shift.

QT Ending and Liquidity Conditions: The Tide Is Turning

With quantitative tightening ending December 1, the liquidity backdrop is shifting from headwind to tailwind.

Central bank balance sheets globally have stabilized. China and ECB are expanding again. Funding markets remain calm:

• SOFR-repo spreads: Well-behaved, no stress signals

• Cross-currency basis swaps: Not flashing dollar funding stress

• Reserve balances: Remain ample

There’s no evidence of the plumbing stress that preceded previous market dislocations. The liquidity picture is improving.

Liquidity Score: 0 (Neutral) | Trend: ↑ | Key Level: SOFR-repo spreads above 30bps would signal stress.

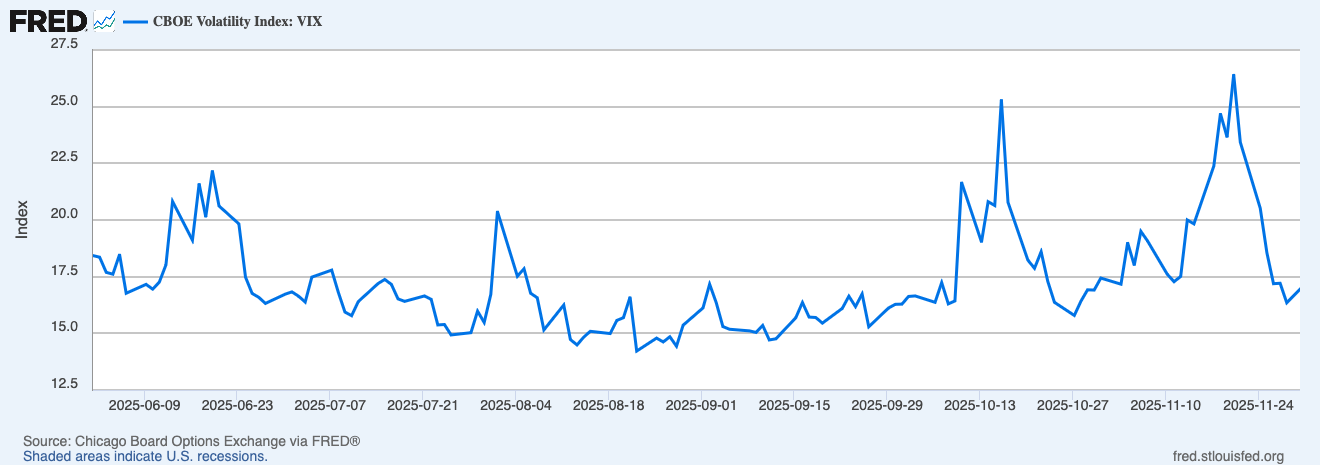

VIX and High Yield Spreads: Risk Appetite Neutral, Not Euphoric

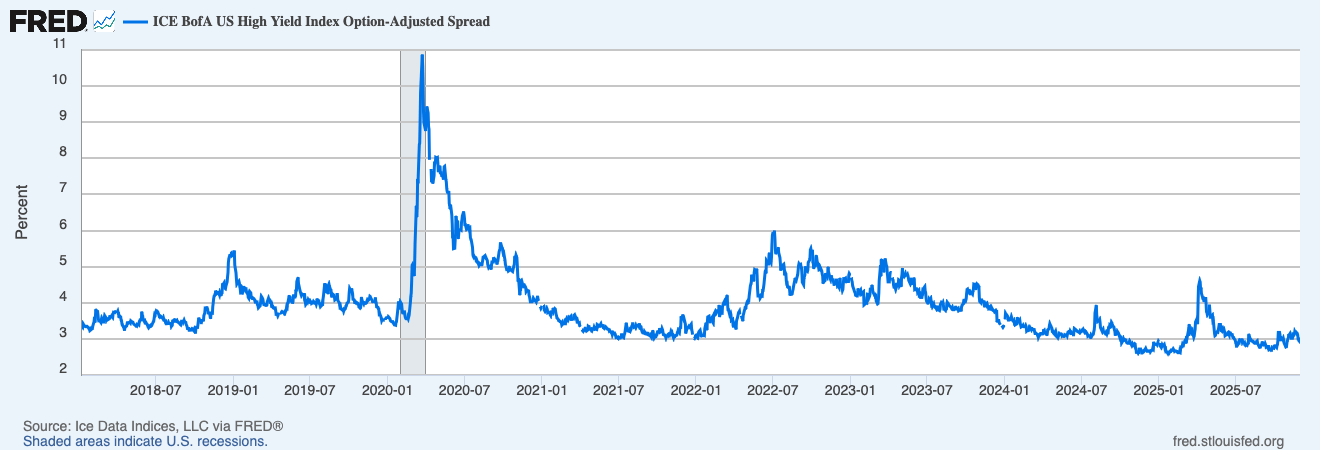

The VIX at 16-17 is low but not complacent. High yield OAS spreads at 300-350bps are near historically tight level but not screaming. S&P 500 at 6,850 sits near all-time highs after a strong November.

This isn’t risk-off. But it’s not euphoric either.

ETF flow analysis shows a -0.33 net signal - a slight defensive tilt. Risk-on ETFs (SPY, QQQ, financials, energy) saw solid November flows, but defensive ETFs (TLT, GLD, utilities) are also getting bid. The market is maintaining insurance even as it participates in upside.

High yield spreads at 300-350bps are telling you “no recession.” Credit investors are usually early to see stress. HY OAS above 400bps would be a regime-shift signal worth watching.

Risk Appetite Score: 0 (Neutral) | Trend: → | Key Level: HY OAS above 400bps or VIX sustained above 25.

Cross-Asset Implications for a Reflation Regime

Given Reflation with restrictive policy still in place, here’s how the regime framework historically translates across asset classes.

Equities

The Reflation regime historically favors equities over bonds, but selectivity matters at stretched valuations. At 22.2x forward P/E, the margin for error is thin.

Large-cap quality with pricing power tends to handle this environment well historically. Companies that can pass through cost inflation while maintaining margins have outperformed in past Reflation regimes.

Small caps historically benefit from rate cuts given their floating-rate debt exposure, but they also tend to under-perform first if growth rolls over.

Sector rotation patterns in Reflation historically show value outperforming growth at the margin. Financials, industrials, and energy have outperformed in past Reflation regimes when real rates stay positive and commodity prices hold.

Rates

With Core PCE at 2.8% and the Fed still restrictive, the historical pattern doesn’t favor duration.

Curve steepening is the textbook Reflation dynamic. As the Fed eases the front end while the long end reprices inflation risk and fiscal deficits, the curve steepens. This pattern has played out consistently in past Reflation environments.

Duration historically faces headwinds in Reflation until something breaks on the growth side.

Credit

Spreads at 300-350bps mean compensation for credit risk is historically thin.

Investment grade historically offers better risk-adjusted returns than high yield at these spread levels, less volatility while still capturing benefit from Fed easing.

The 400bps level on HY OAS has historically marked regime shifts. Credit is telling you “no recession” at current spreads, but credit has been late to see stress in past cycles.

FX and Commodities

Dollar dynamics depend on the inflation path. If inflation stays elevated, the Fed stays cautious, and real rates stay positive - that’s historically dollar-supportive.

Gold looks tactically extended after a massive run, even though the structural case (central bank buying, real rate normalization) remains intact.

Energy historically benefits in Reflation when global growth stabilizes and commodity demand holds.

Regime Signposts: What Would Change the View

Inflation breaks 3.0%: Core PCE above 3.0% or hot CPI print would complicate the Fed’s easing path. Rates would likely reprice higher, creating headwinds for equities.

Growth rolls over: ISM Manufacturing below 45 or ISM Services below 50 collapses the two-speed economy thesis. Shifts regime toward Stagflation.

Credit stress emerges: HY spreads widening above 400bps or SOFR-repo spread spike signals risk appetite turning.

VIX sustains above 25: Market repricing risk structurally, not just hedging an event.

Bull case: ISM Manufacturing crosses back above 50 AND Core PCE trends toward 2.5%. That’s the shift from Reflation to Goldilocks—historically the sweet spot.

The Bottom Line

Current Regime: Reflation | Growth expanding, inflation rising, policy restrictive.

The regime historically favors equities over bonds, cyclicals over defensives at the margin, and curve steepening over outright duration. But at 22.2x forward P/E, the margin for error is thin.

• Valuations stretched: S&P 500 at 22.2x forward P/E

• Inflation not cooperating: Core PCE 2.8%, Core CPI 3.3%, both rising

• Policy still restrictive: Real Fed Funds above +1.7%

The soft landing is possible. But it requires growth resilience, inflation stabilization, and Fed cooperation simultaneously.

See you next Sunday.

The Setup is published every Sunday evening. For deeper dives on specific sectors and themes, check out The Breakdown (monthly). If something material shifts mid-week, you’ll hear from me via The Pulse.

Questions or feedback? Drop me a line at [email protected]

Disclaimer

All content published by MacroAnalytix is for research and educational purposes only. Nothing on this site or in our publications should be interpreted as financial advice, investment recommendations, or a solicitation to buy or sell securities.

You are solely responsible for your own financial decisions. Please conduct your own due diligence and consult with a licensed financial professional before making any investment or decisions.