Regime Scorecard: The Economy Is Fine, The Plumbing Isn’t

The cracks are showing.

Two weeks ago, we were in Goldilocks territory with a supportive liquidity backdrop. Last week, the Fed cut as expected but signaled only one more cut for 2026, far fewer than markets had priced. This week? The plumbing is under stress, and the Fed has noticed.

Liquidity has flipped from tailwind to headwind. The Treasury General Account has swelled by $129 billion, sucking reserves out of the system. SOFR-repo spreads have widened to 35 basis points - stressed territory. Bank reserves are down $50 billion.

Here’s the thing: the economy is fine, the plumbing isn’t. The good news? The Fed knows it.

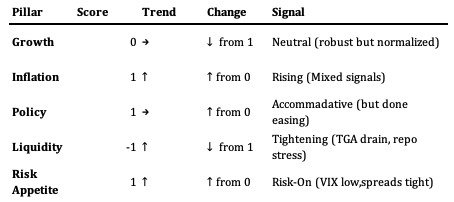

MacroAnalytix Dashboard Scoring

Current Regime: Late Cycle / Reflation Aggregate Score: +2 (Weighted: 1.92)

This is Late Cycle territory. The expansion continues, but the supports are eroding.

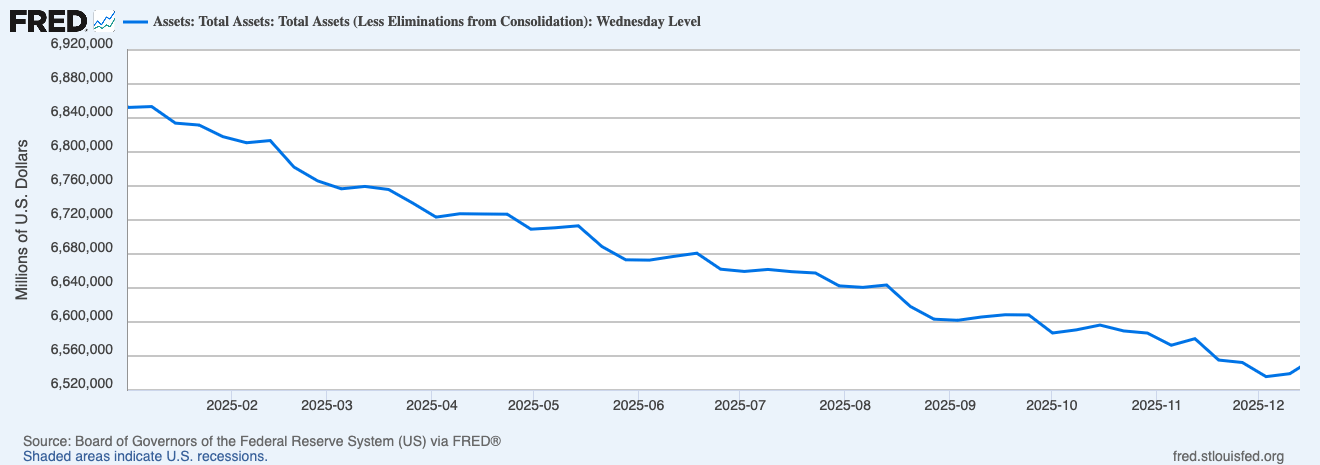

Treasury General Account Drain: How TGA Swelling Tightens Liquidity

This is the story of the week. And the Fed noticed.

The culprit is the Treasury General Account. The TGA has swelled from $677 billion in September to $806 billion - a $129 billion increase. When Treasury builds cash at the Fed, it drains reserves from the banking system. That’s liquidity tightening, regardless of what the Fed is doing.

How the TGA drain mechanism works: 1. Treasury issues bills/bonds 2. Investors pay Treasury 3. Cash moves from bank reserves to the TGA at the Fed 4. Bank reserves fall → funding conditions tighten.

The Fed moved quickly precisely because liquidity conditions have deteriorated. The $40 billion T-bill buying program announced December 12th is the response.

SOFR-Repo Spread at 35bps: Stressed Territory Explained

The stress is showing up in money markets.

SOFR-repo spreads have widened to 35 basis points, up from well-behaved levels. That’s stressed territory. Here’s what it means:

• SOFR = Secured Overnight Financing Rate (benchmark for repo).

• Repo spread = Difference between repo rates and risk-free rate.

• 35bps spread = Banks paying premium for overnight funding.

When spreads widen, it signals: - Reserves are becoming scarce - Banks are competing for funding - Plumbing stress is building.

Key threshold: Spreads above 50bps would signal disorderly funding conditions requiring Fed intervention.

Core PCE vs Core CPI Divergence: Why They’re Moving Apart

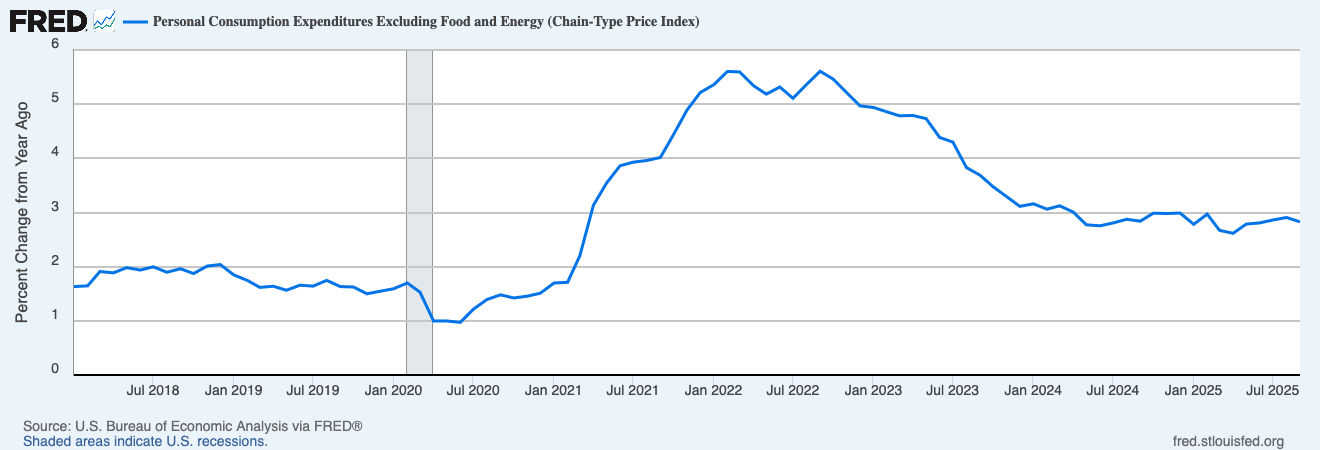

This is the first genuinely encouraging inflation print in months.

Core PCE is still at 2.80% - still above target. PPI plunged from 3.30% to 2.70%, suggesting pipeline pressures are easing.

Core CPI is still at 3.02%: This is the first release since May 2025 which the direction may have changed course.

Why any divergence matters: - PCE and CPI weight components differently - Housing is weighted more heavily in CPI - The Fed watches PCE, not CPI - If CPI is leading and PCE follows, we’re in better shape than headlines suggest.

Market-based measures remain well-behaved. The 5y5y breakeven sits at 2.33%. The Cleveland Fed Inflation Nowcast is tracking 2.40% - right at target.

Inflation Score: +1 (Rising) | Trend: ↑ | Key Level: December 20th Core PCE release is critical.

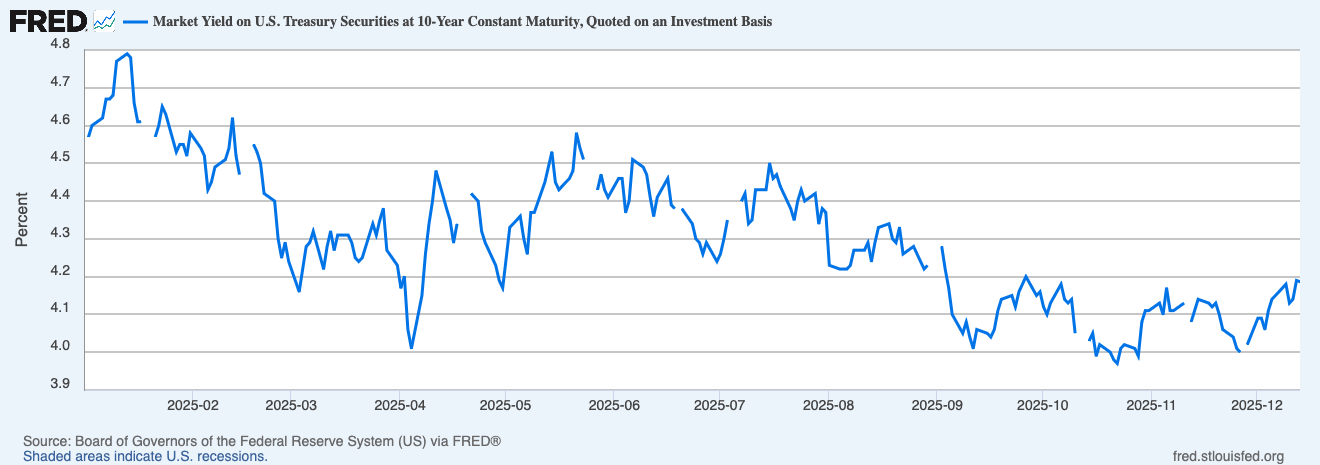

2s10s Curve Steepening: Basis Point Move Explained

The dot plot showing only one cut for 2026 was a hawkish surprise, the market had priced three to four. The curve has steepened dramatically in response.

The 2s10s spread has jumped from +52 basis points to +67 - a 15 basis point move.

What curve steepening means: - Front end: Anchored by Fed cuts already delivered - Long end: Repricing for sticky inflation + fiscal deficits + fewer future cuts - Result: Yield curve steepens.

The curve steepening dynamic discussed in Issue #001 has played out. The question now is whether it continues or consolidates.

Fed T-Bill Buying Program: $40 Billion Response to Liquidity Stress

The Fed’s response shows they’re monitoring funding conditions closely.

Program details: - $40 billion in T-bill purchases announced December 12th - Purchases will “remain elevated for a few months” - Then “significantly reduced”

Why it matters: - Adds reserves back to the system - Offsets TGA drain - Shows Fed will act preemptively on plumbing stress - They learned from September 2019

The program is live but not keeping pace with the $129 billion TGA build. Net effect: reserves are shrinking, not growing.

Cross-Asset Implications for Late Cycle With Liquidity Stress

The liquidity deterioration changes the analysis. Two weeks ago, the backdrop was supportive. This week, caution is warranted.

Duration Dynamics

Duration becoming more interesting. With yields moving higher on the hawkish dot plot, and inflation finally showing progress, the setup for duration is shifting. The hawkish Fed dots are now priced; the inflation improvement isn’t fully reflected.

Rate-Sensitive Assets

Small caps historically struggle with funding stress. They tend to be more sensitive to liquidity conditions given higher leverage and floating-rate debt exposure. The breadth improvement noted in Issue #002 faces a headwind.

Financials

Financials historically benefit from steeper curves. If the move in 2s10s is the beginning of a trend, it improves net interest margin dynamics. Banks are lenders, not borrowers, so funding stress affects them differently than other sectors.

Semiconductors

SMH down 4.52% is notable. The group led the rally; it’s leading the correction. Worth watching whether this is rotation or something more fundamental.

Defensives

Utilities and staples historically provide ballast in funding stress scenarios. The regime deterioration shifts the analysis toward defensive sectors.

Regime Signposts: What Would Change the View

Liquidity stress intensifies: SOFR-repo spreads above 50bps or disorderly year-end funding.

TGA drain reverses: Treasury spending down TGA balance. Watch for drawdowns below $700 billion as a constructive signal.

Core PCE confirms trend: December 20th print at 2.6% or below rebuilds disinflation narrative.

Credit stress emerges: HY spreads above 400bps signals funding stress spreading. Currently 291bps.

The Bottom Line

Current Regime: Late Cycle | Growth positive, inflation improving, but liquidity deteriorating sharply.

The economy is fine. GDPNow at 3.6%. Claims at historic lows. Retail sales accelerating.

The plumbing needs work. TGA up $129 billion. SOFR-repo at 35bps. Reserves draining. But the Fed’s $40 billion T-bill program shows they’re on it.

That divergence is the story.

Questions or feedback? [email protected]

Disclaimer: All content published by MacroAnalytix is for research and educational purposes only. Nothing in this publication should be interpreted as financial advice, investment recommendations, or a solicitation to buy or sell securities. You are solely responsible for your own financial decisions.