Why This Pulse

The Fed cut. Markets got what they expected. And then the dot plot landed.

One cut for 2026. Not three. Not two. One. Three dissenting votes, the most since 2019 and buried in the fine print: $40 billion in T-bill purchases starting Friday. Nobody saw that coming.

The regime holds. But the path just got a lot narrower.

The Decision: Dot Plot Delivers Hawkish Surprise

Markets came in pricing roughly four cuts for 2026. The dot plot delivered one. That’s not a minor recalibration, it’s the Fed telling you the easing cycle is approaching its end far sooner than consensus expected.

Three-Way Vote Split

Here’s what caught my attention: the vote split three ways.

Dissent | Position | Pattern |

Governor Miran | Wanted 50bps cut | Third consecutive dissent for larger cuts |

President Schmid | Preferred no change | Hawkish hold |

President Goolsbee | Preferred no change | Hawkish hold |

That’s the fourth consecutive non-unanimous decision, the longest streak since 2019. Powell calls it “healthy debate.” I’d call it a committee that doesn’t know where it’s going.

The Political Dimension

Miran - Trump’s sole appointee on the committee, has now dissented for larger cuts at three straight meetings, a remarkable streak that underscores the political crosscurrents Powell will face in 2026. With Powell’s term ending in May, the Fed’s independence is about to get stress-tested.

Powell’s Framing

Powell’s language was telling:

“Risks to inflation are tilted to the upside and risks to employment to the downside, a challenging situation. There is no risk-free path.”

That’s not the language of a central bank confident in its trajectory. That’s a committee hedging its bets.

The Liquidity Surprise: $40 Billion T-Bill Buying Program

Buried in the announcement: the Fed will resume Treasury bill purchases starting with $40 billion in the first operation (Friday, Dec 12). Purchases will “remain elevated for a few months” before being “significantly reduced.”

This wasn’t in anyone’s base case. And for the regime framework, it matters.

In Issue #002, I scored Liquidity at +1 based on QT ending. This T-bill buying is an additional tailwind—reserve balances will expand, not just stabilize. The plumbing just got easier. That’s the offsetting force against the hawkish dots.

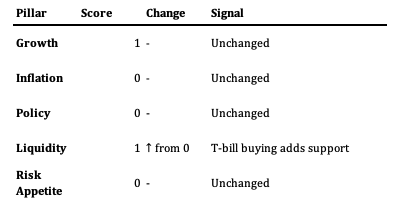

Updated Regime Scorecard

MacroAnalytix Dashboard Scoring

Current Regime: Goldilocks (unchanged) | Aggregate Score: +2

Regime Implications

Policy: From Easing to Extended Pause

The move from “easing” to “extended pause” changes the assessment. With only one cut projected for 2026, we’re looking at rates staying around 3.25%-3.5% through most of next year.

That’s still restrictive relative to neutral—but the direction of travel has stalled. Policy stays at 0 (Neutral), but the trend arrow flips from ↓ to →. That distinction matters for rate-sensitive positioning.

Liquidity: The Silver Lining

T-bill buying is unambiguously positive. Liquidity stays at +1 (Supportive), trend →. The Fed is adding reserves into year-end, not just maintaining them. For risk assets, this is the silver lining in an otherwise hawkish package.

Fed Projections

The Fed’s updated projections show: - GDP 2026: 2.3% - Core PCE year-end: 2.4%

Sticky-but-improving inflation alongside modest growth. That’s consistent with our Goldilocks read.

Cross-Asset Implications

Curve Steepeners

The thesis from Issue #002 still works, but the magnitude narrows. With only one cut priced for 2026, the front-end won’t rally as much as anticipated. The dynamic remains valid—Fed at the margin easier while long-end reprices fiscal and inflation risk—but expected returns compress.

Duration

The 10-year entry point thesis from Issue #002 still holds. Today’s hawkish dots may provide that opportunity in coming sessions as rates reprice higher. If 10s push toward 4.4-4.5%, that’s the level flagged for adding duration.

Small Caps

Here’s the interesting part: the Russell 2000 hit record highs post-announcement. Markets are looking through the hawkish dots to the liquidity tailwind. The T-bill buying program adds fuel to the small cap setup.

EUR/USD

The tactical long toward 1.19-1.20 takes a hit. Hawkish Fed dots narrow the rate differential compression. The thesis is wounded, not dead. European data would need to surprise materially to revive it.

The Bottom Line

The Fed cut as expected. The message was clear: don’t expect much more.

Key takeaways:

One cut for 2026 is materially below consensus

Three dissents signal a committee at odds with itself

The T-bill buying provides an offsetting liquidity tailwind

The regime doesn’t change. We’re still in Goldilocks territory. But the policy path has flattened, and the margin for error just got thinner.

See you Sunday.

Questions or feedback? [email protected]

Disclaimer

All content published by MacroAnalytix is for research and educational purposes only. Nothing in this publication should be interpreted as financial advice, investment recommendations, or a solicitation to buy or sell securities. You are solely responsible for your own financial decisions.