Why This Pulse

Since Sunday’s Issue #001, the growth picture has strengthened. ISM Services accelerated while labor market data continues to demonstrate resilience, pushing the Growth pillar from +1 to +2. Meanwhile, policy conditions have eased slightly, with the Policy pillar moving to neutral. The overall regime remains unchanged: Reflation with Goldilocks characteristics.

The headline numbers moved and this time they’re pointing in the same direction.

The Confirmation: ISM Services + Initial Claims

Two data points this week reinforced each other. When multiple growth indicators align, the signal strengthens.

ISM Services Acceleration

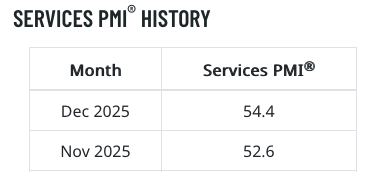

ISM Services rose to 54.4 in December from 52.6 in November - a 1.8-point acceleration that exceeded expectations. With services comprising roughly 70% of US economic output, continued expansion in this sector is the foundation of the soft landing narrative.

The composition of the report supports the headline: - Expansion above 50 for consecutive months - Services activity accelerating, not just holding - The dominant sector of the economy is pulling its weight

At 54.4, we’re comfortably in expansion territory. This isn’t a sector barely hanging on, it’s a sector with genuine momentum.

Initial Claims Resilience

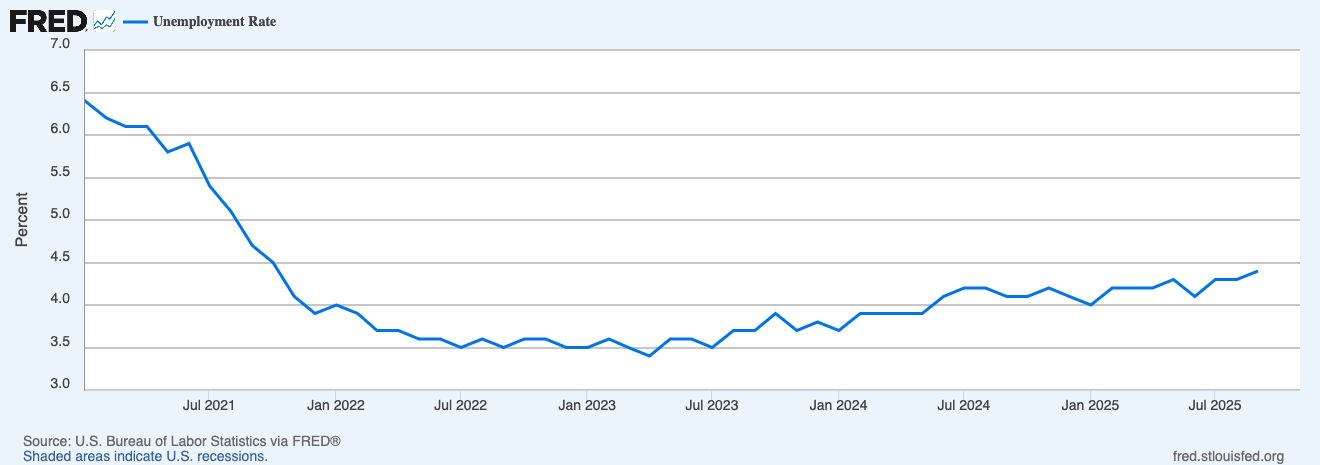

Thursday’s initial jobless claims painted the same picture. Claims came in slightly above consensus at 237,000 but remain well below levels associated with labor market stress.

The four-week average remains historically low and consistent with tight employment conditions. Continuing claims edged higher but haven’t broken out of their recent range.

Why Alignment Matters

When ISM Services and labor market data point in the same direction, the growth signal is clean. No need to adjudicate between conflicting indicators when everything is coherent.

The composite result: Growth strengthens to +2.

Corroborating the upgrade: the Atlanta Fed’s GDPNow model is tracking Q4 growth well above trend.

Services expanding. Labor market tight. Real-time GDP tracking strong. The growth signal isn’t ambiguous this week - it’s confirmed.

Updated Regime Scorecard

MacroAnalytix Dashboard Scoring

Current Regime: Reflation / Goldilocks (unchanged)

Methodology: Pillar scores reflect z-score deviations from 2010-2019 cycle norms, weighted by leading indicator reliability. Full framework detailed in Issue #001.

Regime Implications

Growth at +2 reinforces the Reflation thesis from Issue #001. Stronger economic momentum paired with elevated inflation keeps the Fed cautious on rate cuts and maintains restrictive real rates. The shift in Policy to neutral - reflecting evolving market expectations for the December meeting provides some offset, but doesn’t materially alter the regime dynamics.

This configuration historically favors

Commodities over duration

Cyclical value over growth

Reflation beneficiaries over rate-sensitive assets.

The Tariff Variable

One variable the framework doesn’t fully capture: trade policy uncertainty. Tariff rhetoric has escalated and the administration’s stance could function as an unscored regime modifier.

Escalating trade tensions would pressure the very cyclicals this regime favors - industrials and materials in particular. The growth backdrop may hold, but policy-induced margin compression could still impair returns. The regime call is intact, but the risk around cyclical exposure has widened.

Cross-Asset Read

Price action aligns with the regime assessment.

Equities: Continue grinding higher, the S&P 500 holds near record levels - consistent with risk appetite remaining firmly positive.

Credit: Spreads are tight. Markets are pricing continued growth, not deceleration concerns.

Volatility: The VIX sits in the low teens.

Rates: Treasury yields have drifted lower, which likely reflects the Policy pillar shift toward neutral rather than growth fears. The 2s10s curve remains uninverted, consistent with the soft landing narrative.

Commodities: Have held firm. Copper and energy are not breaking down, if anything, the stronger growth reading supports their near-term outlook.

Dollar: Stable, suggesting no flight-to-safety behavior beneath the surface.

Friday’s Jobs Report: Framework Implications

Tomorrow’s November payrolls release will either confirm or challenge the +2 Growth reading. Consensus expectations center on solid job gains with unemployment holding steady.

Scenario Analysis

Strong print (NFP beats consensus, unemployment holds or falls):

Validates +2 Growth assessment

Reflation thesis strengthens further

Fed remains cautious on cuts

In-line (NFP meets expectations, unemployment stable):

Confirms current regime reading

No adjustment required

Weak print (NFP misses significantly, unemployment rises):

Would conflict with ISM Services acceleration

Growth pillar reassessment required

Watch for signs the labor market is lagging the survey data

The Bottom Line

This week’s data moved two pillars without changing the regime. Growth strengthened to +2 as ISM Services and labor market data aligned. Policy eased to neutral as rate cut expectations evolved. The net effect: Reflation with Goldilocks characteristics remains the operative framework.

The configuration continues to favor reflation beneficiaries: commodities, cyclical value, and assets that perform in stronger nominal growth environments. Duration remains challenged until the Policy pillar moves more decisively accommodative.

ISM Services at 54.4 is genuine expansion, not a sector barely holding on, but one with momentum. Combined with claims near historic lows, the growth picture is cleaner than it’s been in weeks.

Friday’s jobs report is the next checkpoint. A print consistent with current expectations confirms the +2 Growth reading and maintains the regime. Weakness would warrant reassessment, but would also conflict with the ISM signal, creating the kind of divergence that requires careful interpretation.

Until then, the framework is clear.

The Pulse drops when something material shifts mid-week. For the full regime framework and cross-asset analysis, The Setup publishes every Sunday evening.

Questions or feedback? [email protected]

Disclaimer

All content published by MacroAnalytix is for research and educational purposes only. Nothing in this publication should be interpreted as financial advice, investment recommendations, or a solicitation to buy or sell securities. You are solely responsible for your own financial decisions.