Regime Scorecard: Goldilocks With Every Pillar Trending Down

The regime holds—but just barely.

Last week we opened with Reflation: growth positive, inflation sticky, policy restrictive. This week the picture has shifted. Policy and liquidity have turned more supportive as QT ended and the Fed signals another cut Tuesday. But the interesting part isn’t what’s improved—it’s what hasn’t.

Every single pillar is trending down. Growth fading. Inflation stable but not cooling. Risk appetite neutral despite equities grinding to all-time highs. The scores say Goldilocks. The trends say watch your back.

MacroAnalytix Dashboard Scoring

Current Regime: Goldilocks Aggregate Score: +2

This is Goldilocks with an expiration date. The regime is constructive, but the margin for error has narrowed.

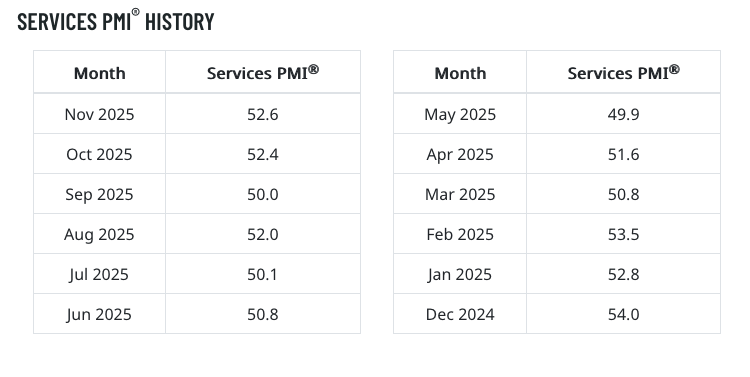

ISM Services Deceleration: Growth Momentum Fading

The economy is still expanding - but the pace is moderating. The ISM Services deceleration from 56.0 to 52.6 is the story.

ISM Services printed 52.6 in November - in line with October. That’s still expansion, but it’s flattening. New orders softened. Employment held. The services economy isn’t rolling over, but it’s no longer driving.

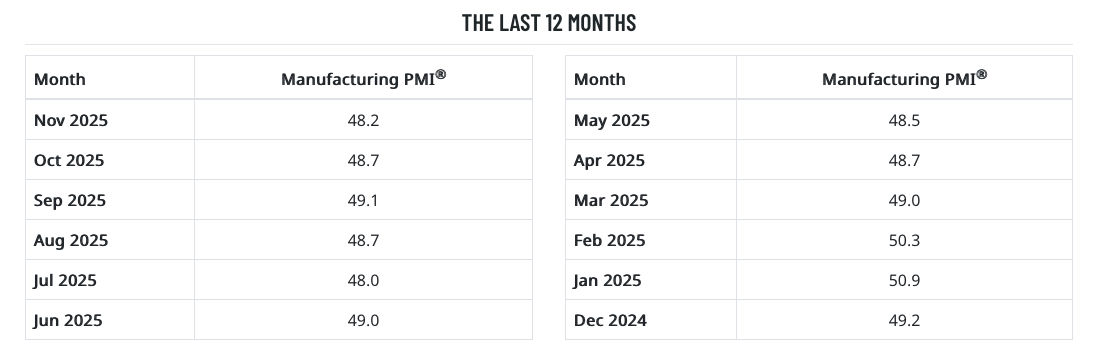

ISM Manufacturing remains stuck at 48.2 - the ninth consecutive month below 50. New orders at 47.1 aren’t screaming recovery. The two-speed economy thesis still holds: services carrying, manufacturing dragging.

The labor market tells a similar story. Payrolls showed 119,000 jobs added - below expectations but not disastrous. Unemployment ticked up to 4.4%. Weekly claims at 191,000 are near three-year lows. This is cooling, not cracking.

The distinction matters: Orderly deceleration from above-trend growth is textbook soft landing. The question is whether it stays orderly.

Growth Score: +1 (Expansionary) | Trend: ↓ | Key Level: ISM Services below 50 shifts to Stagflation risk.

Core PCE Stuck at 2.8%: Disinflation Stalled

Core PCE landed at 2.8% year-over-year—unchanged from August. Stuck in the 2.7-3.0% range that’s defined most of 2025. The disinflation trend that dominated 2024 has clearly stalled.

The composition is shifting in ways worth watching: - Goods prices: Rose 0.5% month-over-month, likely early tariff pass-through - Services inflation: 0.2%, sticky but not accelerating - ISM Services prices paid: 65.4, down from 70 but still elevated

This isn’t runaway inflation. But it’s not the smooth glide to 2% that markets had priced. The Fed finds itself in an awkward spot: inflation sticky enough to complicate the cutting cycle, but not hot enough to reverse course.

Inflation Score: 0 (Stable) | Trend: ↓ | Key Level: Core PCE above 3.0% shifts narrative.

Fed Dot Plot Interpretation: Tuesday’s Decision and 2025 Path

The Fed cut 25bps in October, bringing the target range to 3.75-4.00%. QT officially ended December 1. Markets are pricing 87% odds of another 25bp cut Tuesday.

But the Fed is making this decision with unusually poor visibility. The government shutdown wiped out October’s CPI entirely. BLS estimates suggest this creates a 0.2-0.3% estimation error in their inflation models. Powell has acknowledged the data gaps.

The FOMC was already divided. October’s decision saw two dissents - one wanting 50bp, another preferring to hold. The committee isn’t unified on the path forward.

Why the Fed dot plot matters more than the cut: Markets expect four cuts in 2025. If the median dot shows three, or worse, two - that’s a hawkish surprise into year-end. The cut Tuesday is priced; the path isn’t.

Policy Score: 0 (Neutral) | Trend: ↑ | Key Level: Dot plot showing only two 2025 cuts triggers repricing.

QT Ending Impact on Liquidity: Headwind Becomes Tailwind

With quantitative tightening concluded December 1, the liquidity backdrop has shifted from headwind to tailwind.

• Reserve balances: Remain ample.

• Standing repo facility: Tapped occasionally ($13.5B overnight) but without urgency.

• Cross-currency basis swaps: No dollar funding stress.

• SOFR-repo spreads: Well-behaved.

The plumbing is functioning. That matters for risk assets.

Liquidity Score: +1 (Supportive) | Trend: ↑ | Key Level: SOFR-repo spreads above 30bps signals stress.

S&P 500 Valuation at 22x Forward P/E: Risk Appetite Assessment

Equities have ground higher for eight consecutive sessions. The S&P 500 is pushing all-time highs near 6,850. The VIX has collapsed to 15.75.

Cross-Asset Valuation Snapshot:

Asset | Current | Historical Norm |

S&P 500 Fwd P/E | 22.1x | 18.2x (+21% rich) |

HY OAS | 289 bps | 400 bps (-28% tight) |

10Y Real Yield | 1.95% | 0.75% (+120bps) |

Source: VIX w/ SP500 Overlay

The technicals look healthy. Breadth is improving - 60%+ of S&P constituents trade above their 200-day moving average. Small caps (IWM) are finally participating.

But valuations are stretched. Forward P/E on the S&P sits above 22x. At these multiples, a 10% EPS miss implies roughly 15% drawdown to restore fair value.

Risk Appetite Score: 0 (Neutral) | Trend: ↓ | Key Level: VIX sustained above 25 signals regime shift.

Duration Dynamics: How the Regime Change Affects Rates

This is where the regime change matters most for rates analysis.

Duration dynamics have shifted. In Issue #001, I noted duration faced headwinds with policy restrictive and QT running. Now? QT is done. The Fed is cutting. Real rates are coming down. The calculus has changed.

The 10-year at 4.2% reflects the current regime. If the FOMC dots disappoint (showing only two 2025 cuts), expect a selloff that would push yields higher. The curve steepening thesis from Issue #001 continues to make sense, the Fed eases the front end while the long end reprices for sticky inflation and fiscal deficits.

EUR/USD Fed ECB Divergence Analysis

The policy divergence creates interesting dynamics in EUR/USD.

Factors supporting euro: The Fed is cutting - QT has ended - The ECB is on hold, creating a rate differential that favors the euro

Constraints on the thesis: - The ECB’s hands are tied by growth, not inflation - German manufacturing remains in recession - French political instability has rattled confidence - The eurozone composite PMI is barely above 50

Any risk-off event would see the dollar bid return quickly.

Small Caps Rate Sensitivity Analysis

Small caps present a more interesting setup than in Issue #001. The risk hasn’t disappeared, but the backdrop has improved.

Why small caps historically benefit from this regime: Breadth is finally broadening, IWM is participating after months of underperformance. Higher floating-rate debt exposure means rate cuts directly reduce interest expense. Liquidity supportive with QT ended. Soft landing scenarios historically favor rate-sensitive assets

The setup requires the data to cooperate—soft landing has to hold.

Soft Landing Probability Assessment: 60% Base Case

Our models put soft landing probability at around 60% - down from 70% a month ago as the data has softened, but still the base case.

Probability distribution: 60% Soft landing (growth holds, inflation stabilizes). 25% Hard landing (growth cracks before inflation cooperates). 15% No landing (inflation reaccelerates, Fed forced to pause).

What soft landing historically looks like across assets: Small caps benefit from rate sensitivity working in reverse. Financials benefit from steeper curves and healthy credit. Duration works as growth softens just enough to validate the cutting cycle. EUR/USD grinds higher as Fed-ECB divergence widens.

Regime Signposts: What Would Change the View

Inflation reaccelerates: November CPI Core above 3.2% or December Core PCE above 3.0% complicates Fed’s path.

Growth cracks: November payrolls below 100k or unemployment above 4.5% accelerates growth downgrade. ISM Services below 50 collapses two-speed economy thesis.

Fed hawkish surprise: Tuesday’s dot plot showing only two 2026 cuts, or Powell pushing back on easing expectations.

Bull case: ISM Services holds above 52, payrolls above 150k, Core PCE trends toward 2.5%. That’s Goldilocks proper.

The Bottom Line

Current Regime: Goldilocks | Growth positive, inflation stable, policy and liquidity supportive.

The universal downward trend matters. Every pillar is fading. The scores say constructive; the momentum says watch your back. Tuesday’s FOMC is the week’s defining event, the cut is priced, the dot plot isn’t.

See you next Sunday.

The Setup is published every Sunday evening. For deeper dives on specific sectors and themes, check out The Breakdown (monthly). If something material shifts mid-week, you’ll hear from me via The Pulse.

Questions or feedback? Drop me a line at [email protected]

Disclaimer

All content published by MacroAnalytix is for research and educational purposes only. Nothing on this site or in our publications should be interpreted as financial advice, investment recommendations, or a solicitation to buy or sell securities.

You are solely responsible for your own financial decisions. Please conduct your own due diligence and consult with a licensed financial professional before making any investment or decisions.