The signpost that keeps flagging? It's about to get a catalyst.

The Bank of Japan meets today and tomorrow (January 22-23). Markets expect a hold at 0.75%. That's not the story. The story is what Governor Ueda says about the yen and what it means for the carry trade that's been building pressure since August.

The Setup

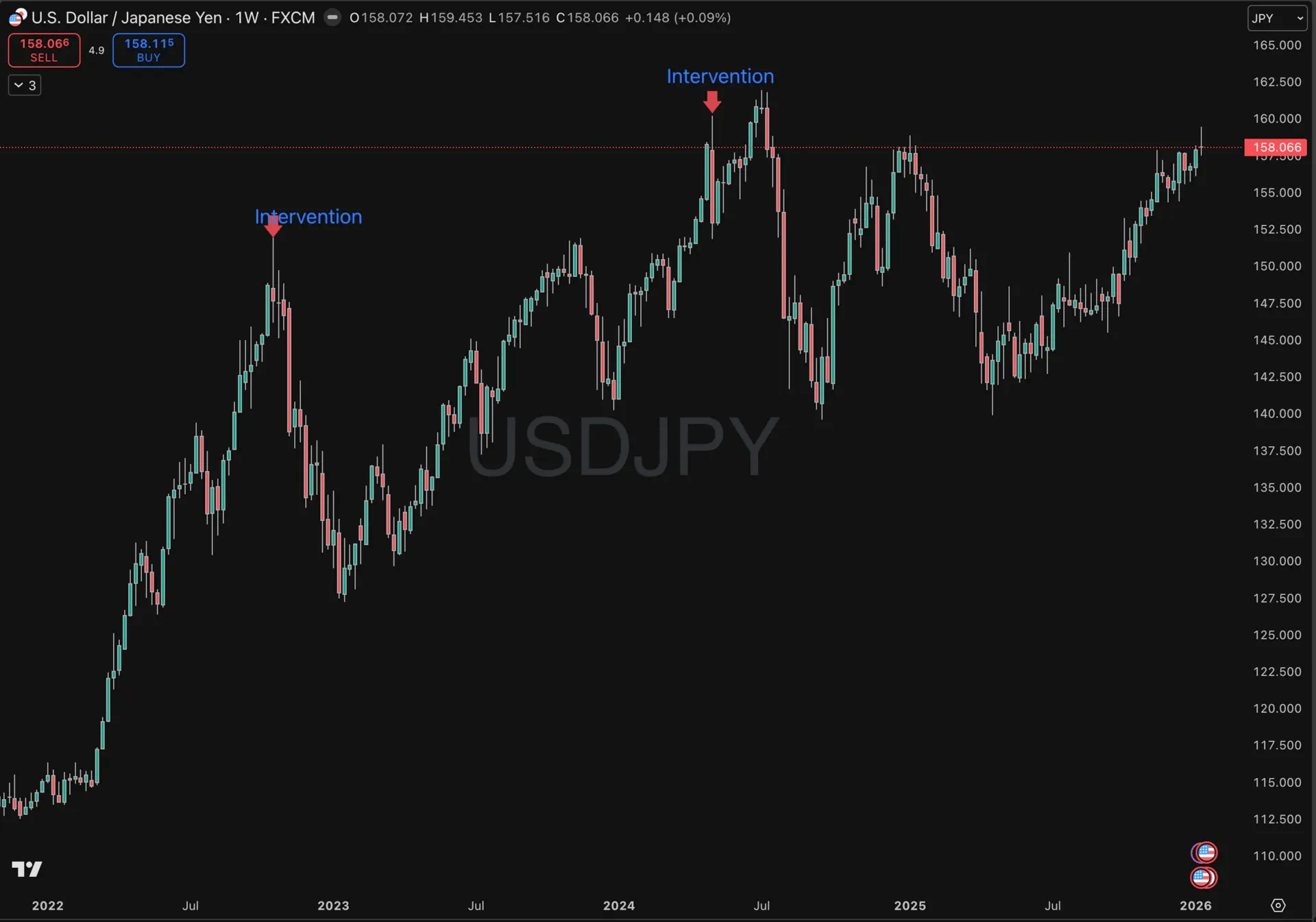

USD/JPY trading around 158.4. That's deep in intervention territory. Japanese authorities intervened at 151.94 in October 2022 and 160.17 in April 2024. We're sitting between those levels, in the zone where Finance Minister Katayama has repeatedly warned that "some episodes of yen depreciation do not reflect fundamental factors."

This isn't new. I've flagged this signpost in every issue since The Setup #005. What's new: we're about to hear directly from the BoJ with the yen at these levels.

What markets are pricing: Near-zero probability of a hike this week. Next hike expected July 2026 after spring wage negotiations confirm. But here's the wrinkle, Citi just flagged risk of three rate hikes in 2026 if yen weakness persists. Multiple analysts note the next hike "could be brought forward depending on yen depreciation."

That's the tail risk. A hawkish signal that the yen's weakness is accelerating the BoJ's timeline.

What to Watch

Ueda's tone on the yen. Dovish or neutral = yen weakness continues, carry trades stay comfortable, USD/JPY grinds toward 160. Any explicit linkage between yen weakness and inflation management = warning shot.

The Outlook Report. The BoJ is expected to raise its fiscal 2026 growth projection above last October's 0.7% estimate. Look for any changes to inflation forecasts, upgraded inflation expectations would support a faster hiking path.

Neutral rate guidance. This is the sleeper. If the BoJ signals a neutral rate of 1.5-2% (versus current 0.75%), that implies multiple hikes ahead. That's the scenario where carry trades unwind fast.

The Carry Unwind Risk

August 2024 gave us the preview. When the yen reversed, EEM dropped 8% in three sessions. High-yielding EM currencies; MXN, BRL, ZAR, all got crushed as funding costs spiked. Leveraged funds running carry trades were forced to liquidate risk assets to cover yen shorts.

Right now, leveraged funds are the most bearish on yen since July 2024. That's a crowded short. Crowded shorts can reverse violently when the catalyst arrives.

The catalyst could be hawkish BoJ guidance. Or intervention headlines. Or simply a statement that the Bank is "watching the yen closely". Standard verbal intervention that can move the pair 200 pips in a session.

Regime Implications

The framework shows three signposts still triggered: USD/JPY above 152, DXY below 100, Gold above $300. All three point the same direction, dollar weakness combined with a safety bid.

If the BoJ triggers a yen reversal: USD/JPY drops toward 150 initially, potentially testing 145-140 on a sustained unwind. Risk assets gap lower as carry trades liquidate. EM FX particularly vulnerable. Gold likely catches a bid as safe-haven flows accelerate.

The regime stays Neutral/Chop regardless. But the path through that regime gets a lot choppier.

The Political Wildcard

PM Takaichi dissolved parliament on Friday (Jan 20). Snap election February 8. She's proposed a two-year halt to the 8% consumption tax on food, fiscally expansionary, yen-negative. Political uncertainty typically strengthens the yen short-term (domestic hedging), but her policy platform is structurally bearish JPY.

The BoJ will navigate this meeting knowing election uncertainty is high. That argues for a neutral tone but Ueda has also signaled he won't let political considerations dictate monetary policy.

The Bottom Line

Hold expected. Watch the tone.

This week's data, gold above $4,900, Russell 2000 hitting its record high all tells one story. The yen at 158 tells another. The divergence between risk assets rallying and the safety signpost screaming hasn't resolved.

The BoJ meeting is the next opportunity for resolution. Either Ueda stays neutral and USD/JPY grinds higher toward 160, or he tips hawkish and we get the unwind the signpost has been warning about.

I can't tell you which one happens. I can tell you the asymmetry is unfavorable at these levels. Carry trades look attractive until they don't. And when they don't, they don't give you time to react.

Questions or feedback? [email protected]

Disclaimer

All content published by MacroAnalytix is for research and educational purposes only. Nothing in this publication should be interpreted as financial advice, investment recommendations, or a solicitation to buy or sell securities. You are solely responsible for your own financial decisions. Please conduct your own due diligence and consult with a licensed financial professional before making any investment decisions.